Bullish case

Buy the BTC/USD pair as the momentum continues.

Have the initial take-profit at 50,000.

Add a stop-loss at 35,000.

Bearish case

Set a sell stop at 35,000 and a take-profit at 30,000.

Add a stop-loss at 40,000.

The Bitcoin price (BTC/USD) soared to a record high of $47,405 after positive events from Tesla. The currency has now risen by more than 60% year-to-date, making it the best-performing major asset. It has risen by more than 1,000% from its lowest level in 2020.

Tesla Bets on Bitcoin

In the past few years, Tesla has moved from a relatively small niche electric car startup to become the biggest automaker in the world with a market cap of more than $804 billion. Its founder, Elon Musk, has also become the richest man in the world, with a net worth of more than $200 billion.

In a disclosure released yesterday, the company said that it had bought Bitcoin worth $1.5 billion. The firm will also start accepting purchases made using Bitcoin in the next few months.

This makes Tesla the most high-profile company to immerse itself in the cryptocurrencies industry. Other notable firms that have bought Bitcoin are MicroStrategy, Square and Mass Mutual. Notably, the market capitalization of MicroStrategy has jumped from about $1.2 billion to more than $9 billion.

Therefore, there are two main reasons why the BTC/USD rallied after the announcement by Tesla. First, the decision by the world’s biggest automaker was an affirmation that Bitcoin is here to stay. Second, as an auto pioneer, investors now believe that more large companies will adopt Bitcoin as an investable asset, which will lead to more demand for the currency.

Still, there are concerns about regulations. In her confirmation hearings, Treasury Secretary and former Fed Chair Janet Yellen pleaded with legislators to curtail cryptocurrencies. This could happen by putting limits on online wallets.

Bitcoin Price Technical Outlook

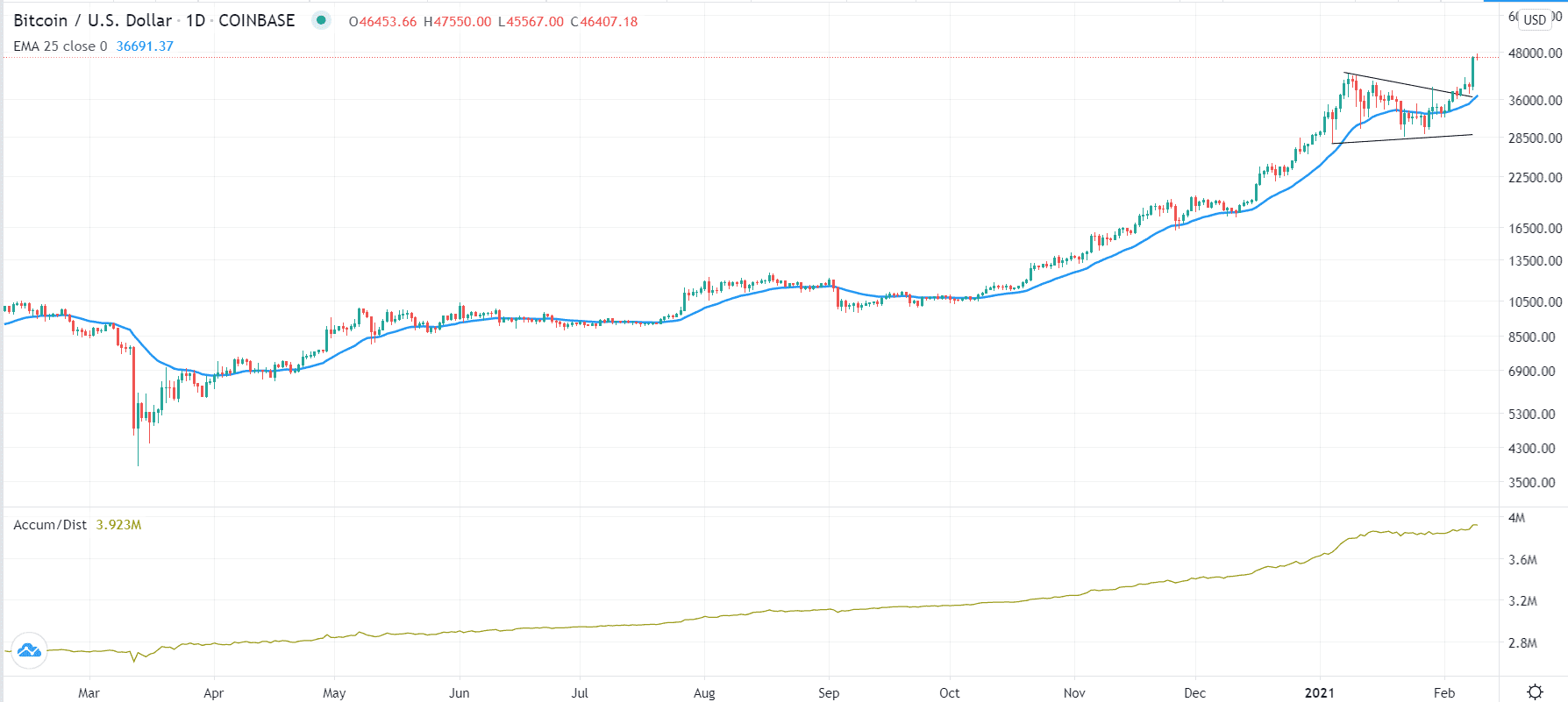

On the daily chart, the Bitcoin price has been in an uptrend. Yesterday, the price broke-out above the bullish pennant pattern after the announcement by Tesla. The price remains above the 25-day moving average. The important accumulation and distribution (A/D) indicator has also continued rising, which is a sign that investors are accumulating the currency.

Therefore, the uptrend will likely continue as bulls target the important resistance at $50,000. However, a drop below $35,000 will mean that there are still sellers remaining in the market.