Last Wednesday’s signals were not triggered, as none of the key levels were reached that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered before 5pm Tokyo time Monday.

Long Trade Idea

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $31,953.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $34,935 or $38,742.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

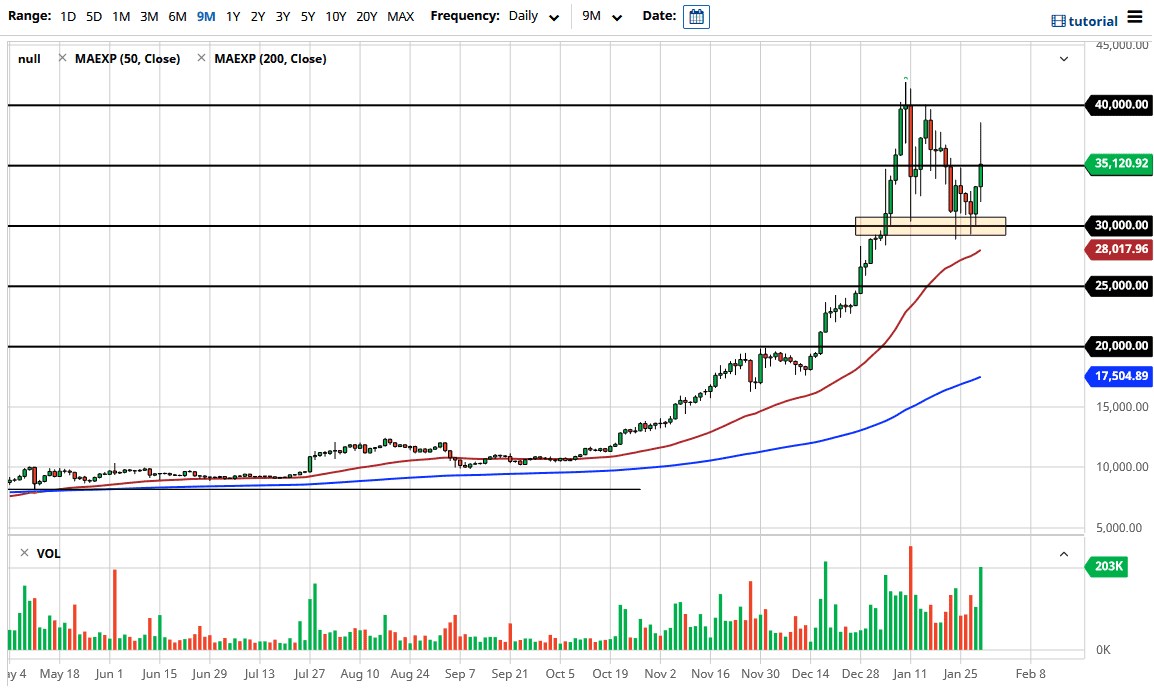

I wrote last Wednesday that despite the bearish action and the fact that we had new bearish trend lines at steeper angles connecting the highs, the price was getting squeezed as the supportive area around the big round number at $30K held up. Therefore, I thought that Bitcoin could be a good buy if we had gotten a bounce at the support level at $28,607.

I thought that the price would descend further over the course of the day over the short term.

Both calls were good – the price did fall over the day Wednesday, before bottoming a little way above the support level identified at $28,607 and then going on to rise slowly but firmly.

The technical picture has become more bullish as we have seen the three bearish trend lines which were holding the price down break.

The price briefly ran as high as almost $39,000 on Friday as the Redditor crowd sought a new target after GME: NYSE – one which could not be so easily manipulated, and settled on Bitcoin, driving the price up in a surge which quickly peaked. It now seems as if the Redditors have moved on to Silver and maybe DogeCoin, assisted in the latter by Elon Musk.

Despite the short-term nature of the buying, it now appears that risk sentiment has recovered and that the price has got established above $32,000.

For this reason, I think that Bitcoin looks like a relatively good buy today if we get a bounce at the support level identified at $31,953.

It will be a bullish sign if the price can get established above the nearest resistance level at $34,935 but it makes sense to call this the round number at $35K instead of that exact level.

Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.