Bullish View

Set a buy stop at the ATH 50,682.

Add a take-profit at 52,000 and a stop loss at 48,000.

Bearish View

Set a sell stop at 49,000 and a take-profit at 47,000.

Add a stop-loss at 51,000.

The BTC/USD's relentless rally accelerated yesterday. Bitcoin price crossed the $50,000 level for the first time on record, meaning that it has risen by almost 1,200% from its lowest level in 2020. It has risen by 67% year-to-date, outperforming all traditional assets like stocks and gold.

Institutions Buying Bitcoin

The BTC/USD price has risen substantially recently, helped by a surge in institutional and high-net-worth buyers. The fear of missing out (FOMO) by retail traders has also played a role.

In the past few months, assets managed by Grayscale Bitcoin Trust have swelled to more than $32 billion. Most of these assets have come from large companies and institutions that view it as the most secure way to invest in the currency.

Similarly, most cryptocurrency exchanges and custodial firms like Coinbase, BitGo, and Fidelity have reported a high volume of Bitcoin investments.

Early this month, Tesla announced that it had bought Bitcoin worth more than $1.5 billion. In the same month, Catherine Wood’s Ark Invest said that it was adding into its investment in Grayscale’s Bitcoin Trust.

Yesterday, MicroStrategy said that it was borrowing another $600 million to invest in the currency. A major unit of Morgan Stanley has also pointed to making BTC investments. Experts believe that this trend is just getting started and that more firms will allocate more funds into Bitcoin.

Other high-profile firms that have expressed interest in Bitcoin are Square, Mastercard, Bank of New York Mellon and Twitter.

However, there are still concerns about what regulators will do. Some analysts believe that central banks and government regulators will work to stifle the currency’s adoption. In fact, Janet Yellen has already pressured policymakers to stifle the currencies.

BTC/USD Technical Outlook

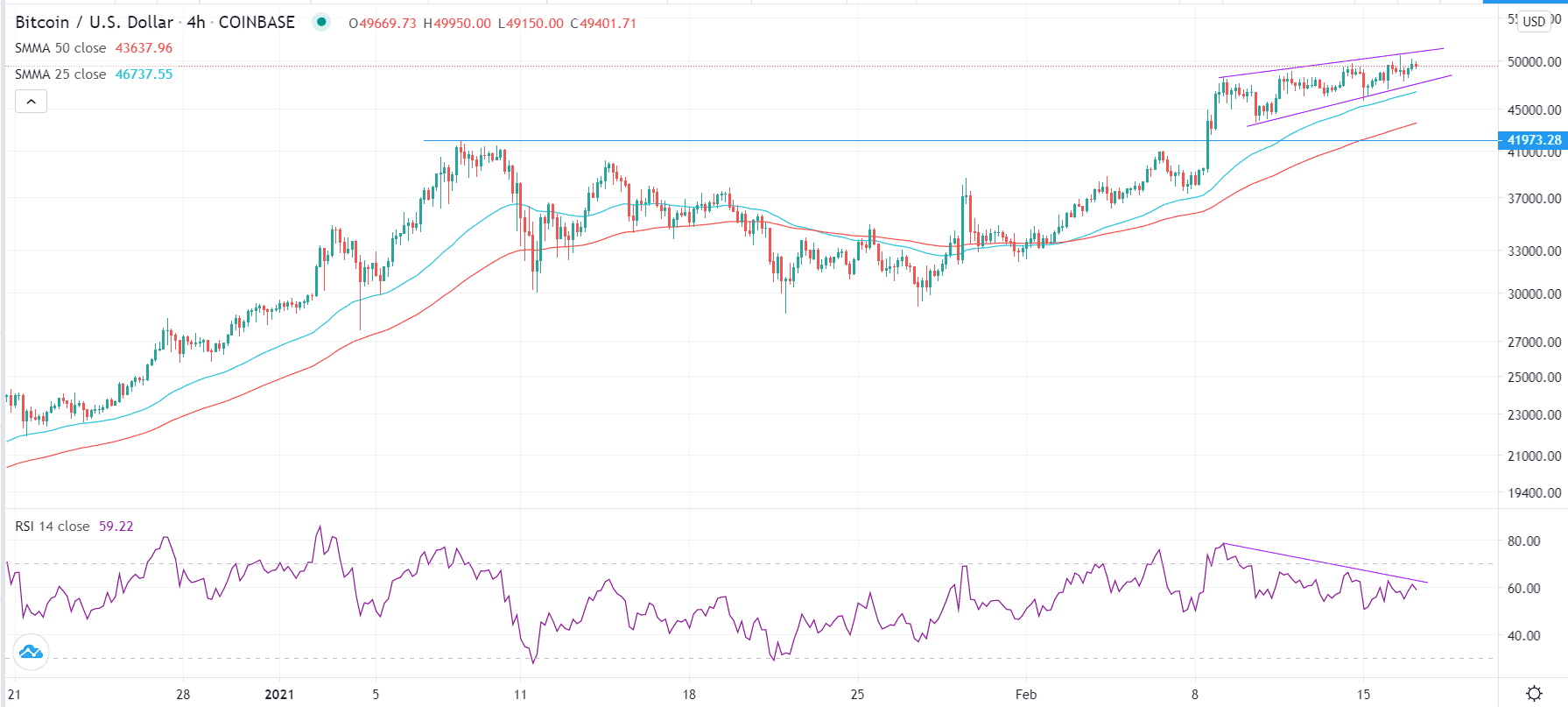

The BTC/USD pair has been in a relatively tight range on the four-hour chart. The pair has formed a small ascending channel whose highest point is at the all-time-high of $50,682.

The Bitcoin price is also substantially higher than the 25-period and 50-period smoothed moving averages. However, the Relative Strength Index (RSI) is showing signs of a bearish divergence.

Therefore, while the upward trend to $55,000 will continue, we cannot rule-out another pull back as speculators take profits.