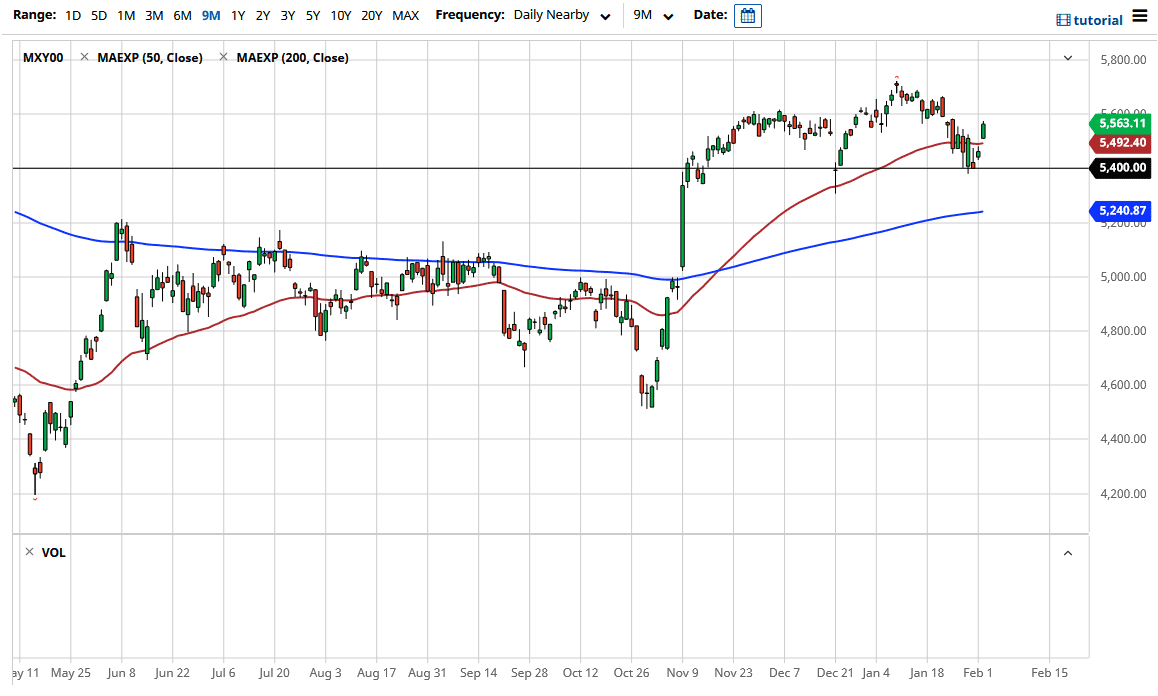

The CAC 40 gapped higher to kick off trading on Wednesday, to not only break above the 5500 level, but also clear the 50-day EMA which had been so important over the last couple of weeks. When you look at the chart, it is easy to see that we have found a significant amount of support in the vicinity of the €5400 level, so it clearly makes sense that we would go racing towards the highs off the bottom after we broke above the top of the inverted hammer from the Monday session.

It was a good day in Paris, as the stock market rose 1.86%, right along many of the other indices globally. It looks as if the 5600 level above could be the next area to pay attention to, but a base has been put in just below, and at this point, pullbacks will continue to be bought into. Furthermore, if the market can break above the 5600 level, then it is very likely to go looking towards the 5700 level after that, which was the recent high. This is being helped by a softening euro, which is currently closer to the 1.20 level in the Forex markets. That does help the idea of French exports being cheaper in various parts around the world, and therefore traders will buy a lot of exporting companies.

If we did break down below the €5400 region, then the next major area of support would be somewhere close to the 200-day EMA. That currently sits at the €5240 level, and then after that we would have the €5000 level offering significant support. I do think that eventually we will see some value hunting on any type of dip, but that is a sentiment that you probably extrapolate from most indices around the world. Obviously, the one thing that is plaguing the European Union is the fact that the turnaround from the pandemic has been slower than other places, especially as the vaccine rollout has stalled a bit. With this in mind, I prefer to look at this as a “buy on the dips” type of market, perhaps using short-term charts in order to make that happen. I do not have any interest in shorting, at least not anytime soon, as the European Central Bank has suggested recently there willing to do more easing if necessary.