Traders once again brush-off disappointing German economic data and pressure for new all-time highs in the DAX 30. Demand from retail traders powers demand, but short-interest by professional traders continues to rise after surging by 158.2% in mid-January. Price action is now moving close to its resistance zone with faltering bullish momentum. It suggests that the DAX 30 remains exposed to a sell-off after moving above 14,000.

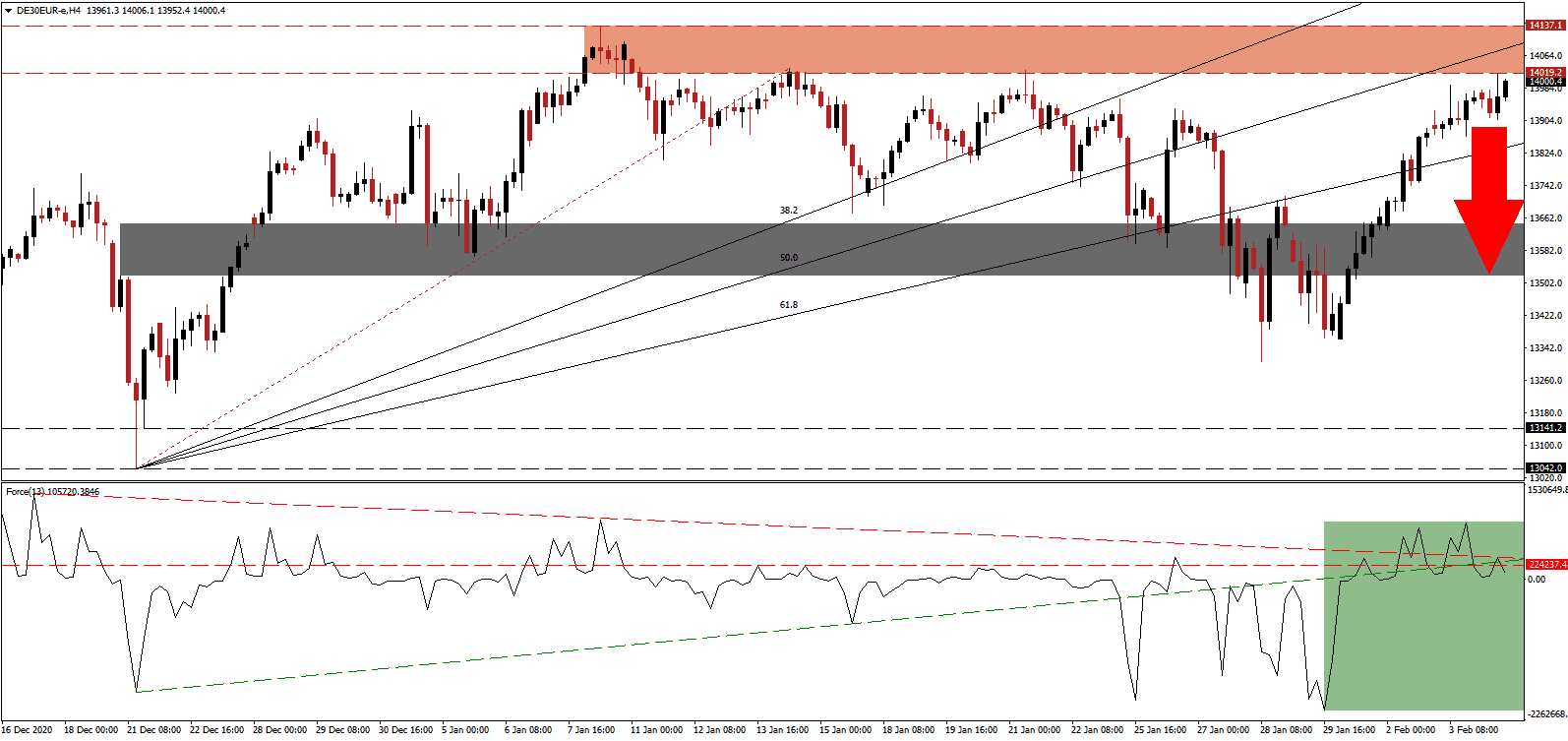

The Force Index, a next-generation technical indicator, retreated from its peak and corrected below its horizontal resistance level. It also moved below its ascending support level, as marked by the green rectangle. The descending resistance level magnifies downside pressures, placing this technical indicator on course into negative territory. Bears remain in charge of price action in the DAX 30.

With German companies expecting COVID-19 restrictions to remain in place until mid-September, the DAX 30 faces ongoing headwinds. The German government announced more stimulus measures, confirming economic pressures ahead. Price action will struggle with its horizontal resistance zone between 14,019.2 and 14,137.1, as marked by the red rectangle, from where a breakdown is likely.

Germany is the 10th most-infected COVID-19 country globally, and retail sales data disappointed. The Service PMI for January slid deeper into contractionary territory, and more debt threatens future growth. The Fibonacci Retracement Fan sequence and the 14,000 psychological level add to bearish developments. The DAX 30 can correct into its short-term support zone between 13,518.0 and 13,648.7, as identified by the grey rectangle.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 14,000.0

Take Profit @ 13,520.0

Stop Loss @ 14,140.0

Downside Potential: 4,800 points

Upside Risk: 1,400 points

Risk/Reward Ratio: 3.43

In case the Force Index reclaims its ascending support level, the DAX 30 could attempt a breakout and fresh all-time high. Given the medium-term economic outlook, traders should sell any rallies from current levels. The upside potential remains reduced to its next resistance zone between 14,278.5 and 14,349.2

DAX 30 Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 14,200.0

Take Profit @ 14,340.0

Stop Loss @ 14,040.0

Upside Potential: 1,400 points

Downside Risk: 600 points

Risk/Reward Ratio: 2.33