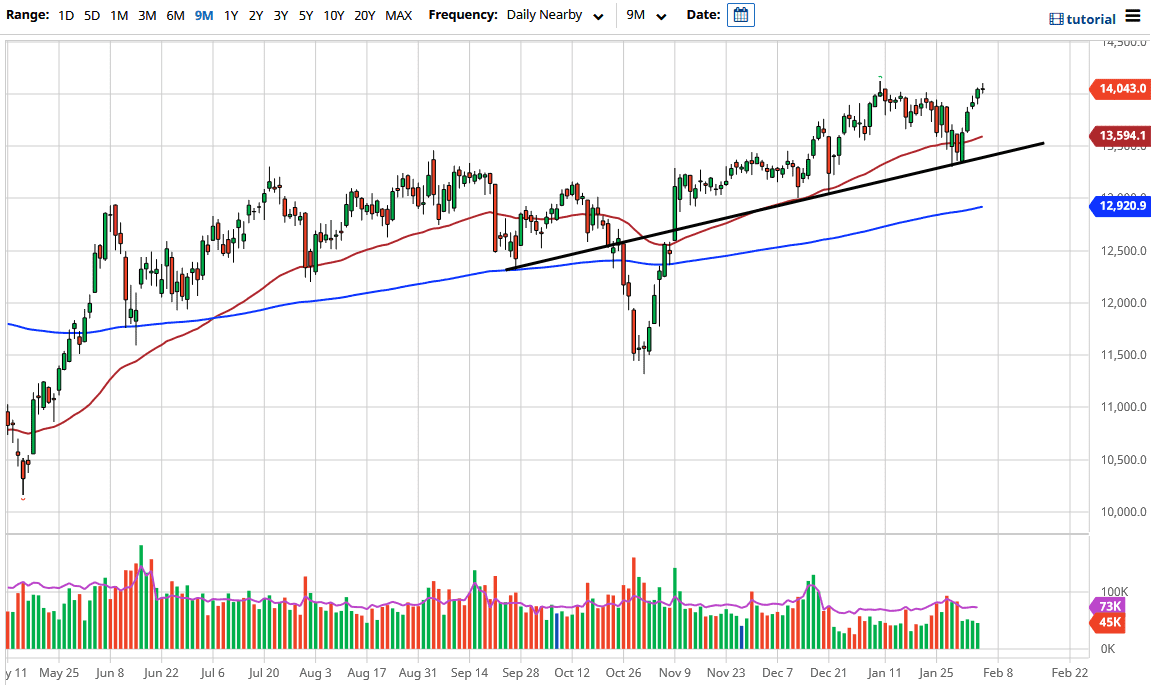

The DAX is struggling just above the 14,000 level heading into the weekend, as we are testing the highs yet again. We could not break out, but that is not a huge surprise considering that we have been waiting for the jobs number from America, so Europe was relatively quiet during the day. The German index is paying attention to the euro, which did gain quite a bit during the trading session. The idea is that exports coming out of Germany might be a little bit more expensive, and that hurts the idea of those companies making larger profits. Nonetheless, I do not think that matters longer term.

The European Union is possibly heading into a double dip recession, but nobody seems to care. This is mainly due to the European Central Bank being likely to flood the markets with liquidity any chance they get, so I believe that the uptrend will continue. However, we may get a short-term pullback, but at the end of the day people will be willing to jump in and pick up this value. The 50-day EMA sits just above the uptrend line, so I think both of those could offer supportive levels, assuming we even get that far. On the other hand, we could turn around and break above the top of the candlestick from the Friday session and simply continue going higher, but we are a bit overdone for the short term.

Longer term, I believe that this market is going to go looking towards the 15,000 level above. As we are sitting at 14,045 at the end of the session, it does not take much imagination to think that we could get there. In fact, I think it will probably make it to that level much quicker than anticipated. I have no interest in shorting the DAX, because just like every other index in the world, everybody is speculating hard on the idea of the reflation trade and a “return to normal.” The candlestick itself does suggest that there is exhaustion, but I would not be overly concerned about any pullback; I think it will simply offer value that a lot of people are willing to take advantage of, as we are in a very strong uptrend and certainly do not want to try to fight it.