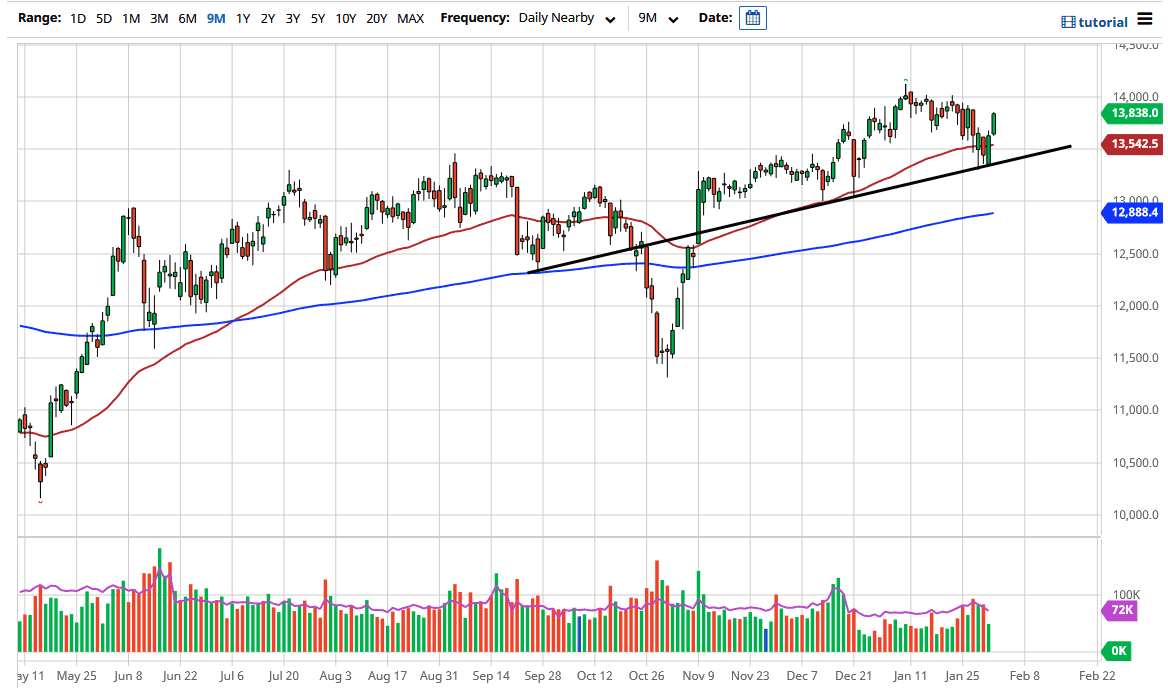

The DAX rallied again during the trading session on Tuesday to reach towards the 13,850 level. The chart of the DAX mirrors almost perfectly the S&P 500, which has also had the exact same setup. When you look at the chart, it is easy to see that the 50-day EMA has attracted a certain amount of attention, and most certainly the uptrend line did as well. To me, it looks as if the market is ready to go looking towards the 14,000 level, which is the recent high.

I do not necessarily think that we will simply slice through the 14,000 level, but I do recognize that it could happen. More likely than not, I would anticipate a short-term pullback in order to find value underneath to find buyers. However, I think this is simply just going to be a buying opportunity. I would have no interest in shorting the DAX, and as the euro looks likely to continue struggling to go much higher, I believe that we will probably see traders willing to jump in and take advantage of what should be good for exports coming out of Germany.

The DAX is an index that should be thought of as the “blue-chip index” of the European Union, with some of the largest companies in the world. It is highly sensitive to exports, so if the euro starts to fall even further, that might be catalyst enough for the DAX to go higher. Regardless, I do not see this is a market that should be sold anytime soon, at least not as long as we are well above the 200-day EMA, which is currently sitting at the 12,888 level. It is not until we break down below there that I will begin to question the trend, and even then, I would be a bit hesitant to get short. In that scenario, I will more than likely be waiting for some type of bounce from an extraordinarily low level that I can take advantage of. Monetary policy being so loose out of the European Union and other central banks around the world almost certainly guarantees that stocks will rise over the longer term. It is a zero interest rate environment; inflation of asset prices tends to be one of the most common themes that you will see over the longer term. I still have a target of 15,000 in the DAX.