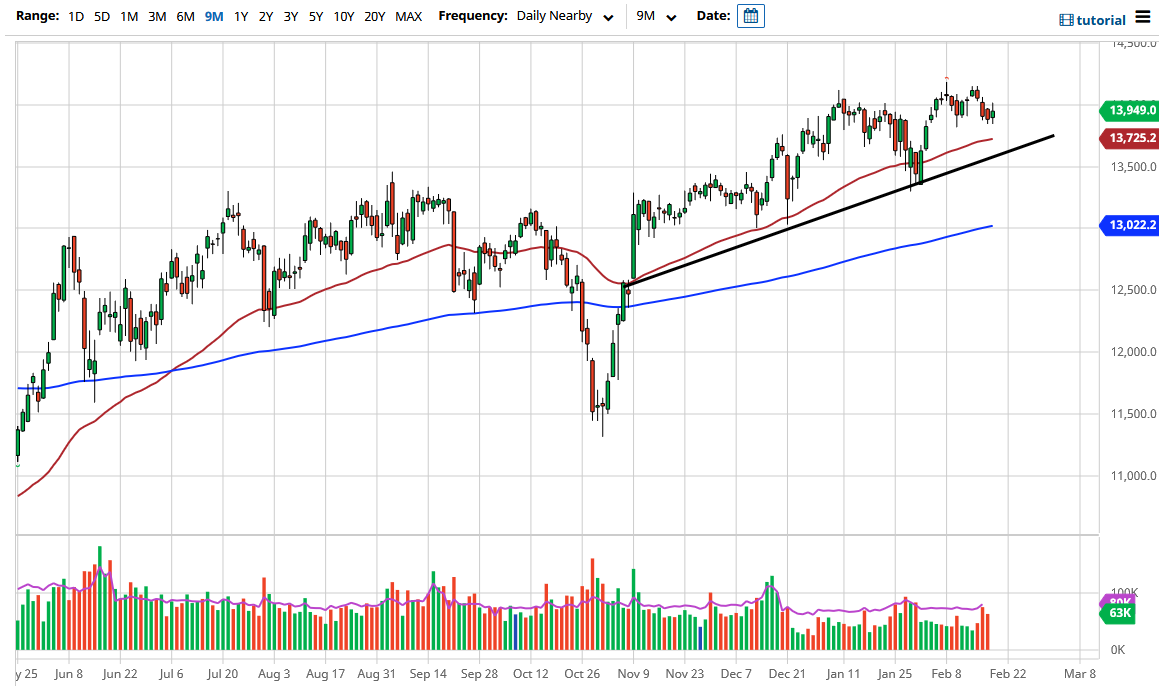

The DAX index reached towards the 14,000 level during the trading session on Friday but then gave back some of the gains in order to form a less than enthusiastic candlestick. Nonetheless, it certainly looks as if the 13,800 level underneath has offered support, and we have been in an uptrend for quite some time. Simply put, I think we are going sideways and, with that in mind, we are going to try to work off the frothing in this market. Now that we are here, I think that the market is simply trying to decide whether or not the 14,000 level is a level that we can live with.

The euro did rally a bit during the trading session and that may have caused some issues, as Germany has a huge proportion of exporters in the DAX, which obviously has an influence here. If we can break above the recent highs though, I think that allows the DAX to go looking towards the 14,250 level, followed by the 14,500 level. To the downside, the 50-day EMA sits at the 13,725 level, and I think that will probably attract a certain amount of technical trading and support. After that, we have an uptrend line that comes into play as well, so I do think that it is only a matter of time before we turn things around.

As long as the world is awash with liquidity, and the ECB looks likely to add to it, the DAX should do fairly well over the longer term. The German index is a way to play the reflation trade as several of the major components of the DAX are industrial exporters that supply so much of the rest of the world, making Germany a particularly strong manufacturing play. At this point, I have no interest in shorting the DAX, but if we did break down below the uptrend line, I think you probably would have to “reset the attitude” of the market, perhaps closer to the 200-day EMA which is sitting at the 13,000 level. I think volatility will continue, but we are still very much in an uptrend, so eventually we will resume the longer-term uptrend that started back in October.