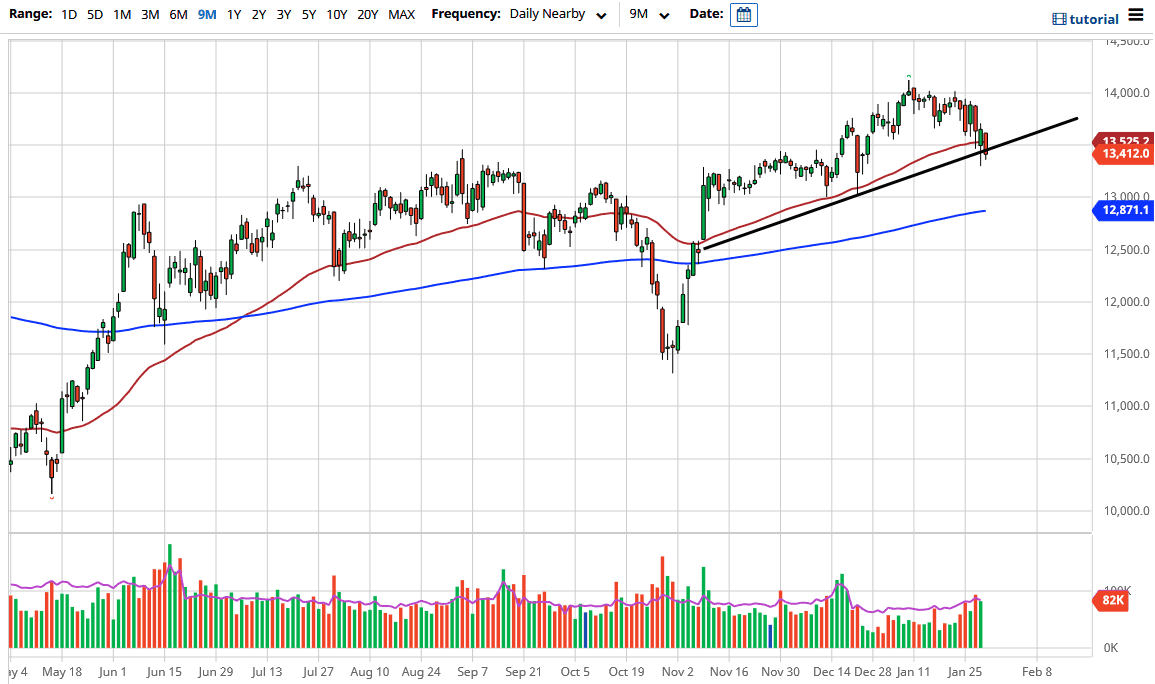

The DAX Index fell during the trading session on Friday to reach down below the 50-day EMA again, and also to test the uptrend line that is currently sitting just below. The uptrend line has held and the market is likely to continue seeing a bit of support just below. Even if we break down from here, I anticipate that the DAX will find buyers closer to the 13,000 level as well, as it is a large, round, psychologically significant figure and the 200-day EMA sits just below it.

To the upside, I think the 14,000 level will be the target eventually, but it may take some time to get there. You can expect a lot of noisy trading on the way back up, and that is quite typically the way the market works: it is very choppy and deliberate on the way higher, but a little bit quicker on the way down. We are very much in an uptrend, and regardless of the noise that we have heard over the last couple of sessions, we should continue to see a lot of buying pressure underneath. After all, the DAX is considered to be the “blue-chip stock index” of the European Union, so it is the first place money goes looking towards.

The 14,000 level above being broken to the upside could open up a move towards the 15,000 level, which is my longer-term target. The 15,000 level is a large psychological figure, but beyond that, I do not see much there that is going to keep the market from going even higher. Central banks around the world continue to flood the markets with liquidity, and that is the only thing that most stock traders care about. Granted, the DAX is not quite as cynical as the US indices are, but nonetheless, it does like stimulus as well. Furthermore, the ECB has suggested recently that they are perhaps going to loosen monetary policy if needed, and that could also help the DAX and other European indices go higher based upon cheaper exports, which is something that stock traders tend to pay close attention to. This is especially true of the DAX, which is so heavily weighted to exporters in Germany.