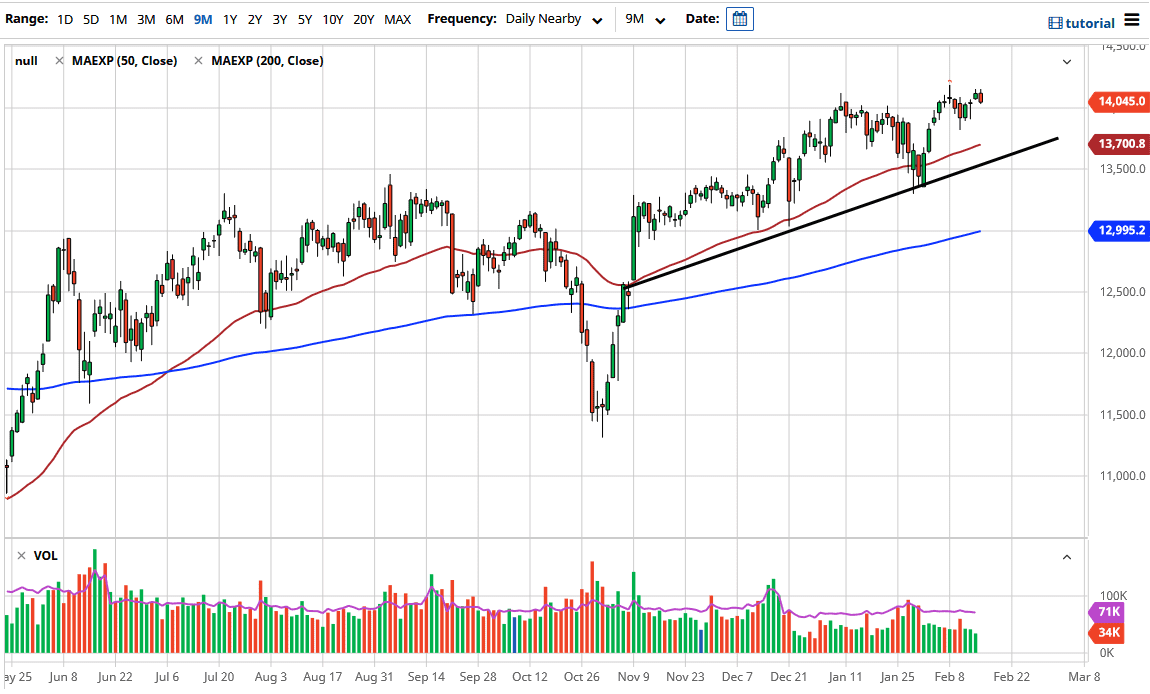

The DAX index rallied initially during the trading session on Tuesday but turned around to show signs of exhaustion yet again. The area seems to be struggling with the 14,200 region and could reach down towards the 14,000 level next. At this point, it is likely that we will probably drop even further than that. However, the market is most certainly in an uptrend and it should continue to see buyers on dips. In fact, it almost looks as if we broke above the bullish flag a couple of days ago, and now we may be testing that flag again. This is a market that probably will go looking towards the 15,000 level eventually, but that does not necessarily mean that we are going to go to that area anytime soon.

To the downside, the 50-day EMA is sitting at the 13,700 level, which is also backed up by a strong uptrend line. The 13,500 level underneath is a large, round, psychologically significant figure and roughly where the uptrend line is currently. This is a market that I think will find plenty of buyers in one of these areas underneath. Given enough time, there will be plenty of value hunters coming back into the DAX due to the fact that the reflation trade will certainly push the idea of industrials going higher, and Germany is a major industrial powerhouse, so the market will favor Germany. Beyond that, it is also the “blue-chip stock index” of the EU,

You could see that the market turning around to break above the highs at roughly 14,200 could lead to an acceleration of the market, but I think right now we are going to see more sideways action than anything else. In general, the market is certainly going to be positive longer term, so I have no interest in shorting the DAX anytime soon, due to the fact that we have so many potential buying opportunities underneath and I believe that the DAX tends to be more of a “buy-and-hold” scenario in general. Liquidity measures will continue to throw money into the stock market, just as we have seen in other countries like the United States.