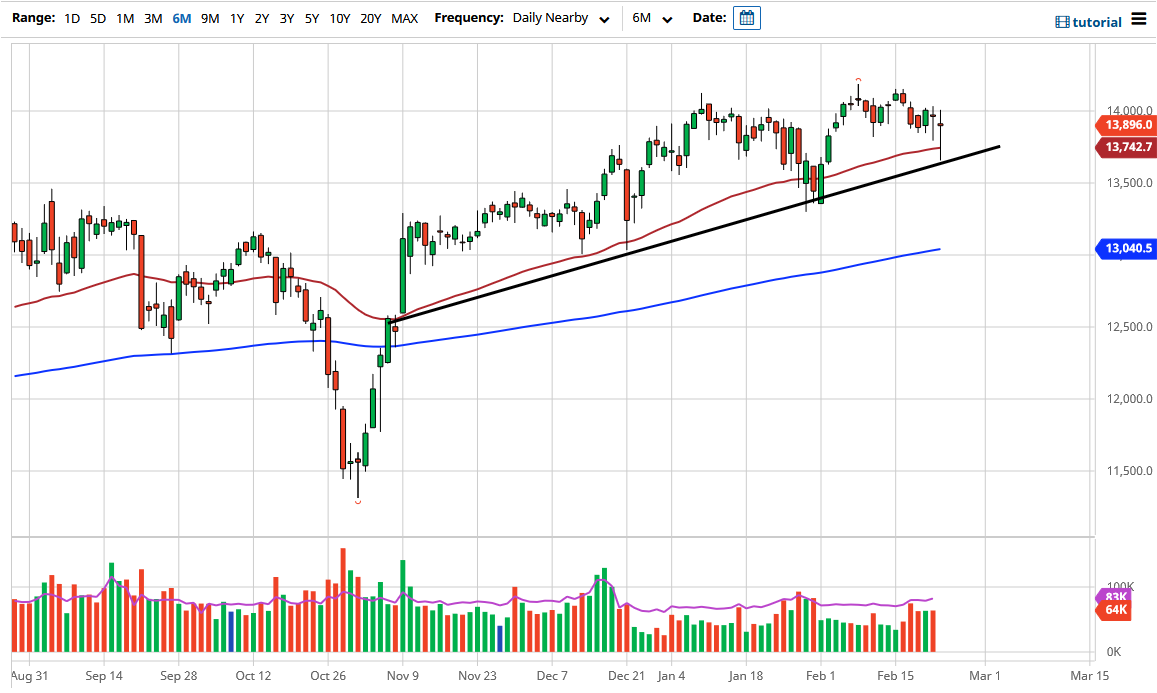

The DAX index tried to break above the 14,000 level during the day on Tuesday only to turn around and break down below the 50-day EMA. We also broke down to reach towards the major uptrend line that you can see on the chart, and then bounced enough to form a massive hammer. The hammer is a bullish sign, and if we were to break above the 14,000 level, it opens up the possibility of breaking out to a fresh, new high to reach towards the 15,000 level after that.

As the European Central Bank is likely to add liquidity into the system, I do believe that the DAX and other indices in the European Union will rally as a result. The massive candlestick that we formed during the trading session shows just how violent the pushback was, so given enough time I think that we will see this market continue to grind higher. This is a market that has been in an uptrend for quite some time, and we are certainly trying to build up the necessary momentum to reach higher levels.

If we were to break down below the uptrend line and perhaps the 13,500 level, I think at that point the DAX would probably go looking towards the 200-day EMA. This is a market that should see plenty of support in that area as well, but it certainly would be a “shot across the bow” of the extremely bullish trend. It is worth noting that the most recent high was just barely higher than the one before it, so it looks like we are running out of momentum just a bit.

The 15,000 level should be a significant barrier from a psychological standpoint, but I think it is too juicy of a target for people to ignore. I would anticipate that a lot of volatility will be seen between now and then, especially as we have to worry about things like the European Union instituting rolling lockdowns, especially Germany. However, if we continue to see the “recovery trade”, that helps Germany due to the fact that Germany has such a huge export sector represented in the DAX. As the economy heats up around the world, you should see exporters in Germany sending industrial materials to various destinations globally.