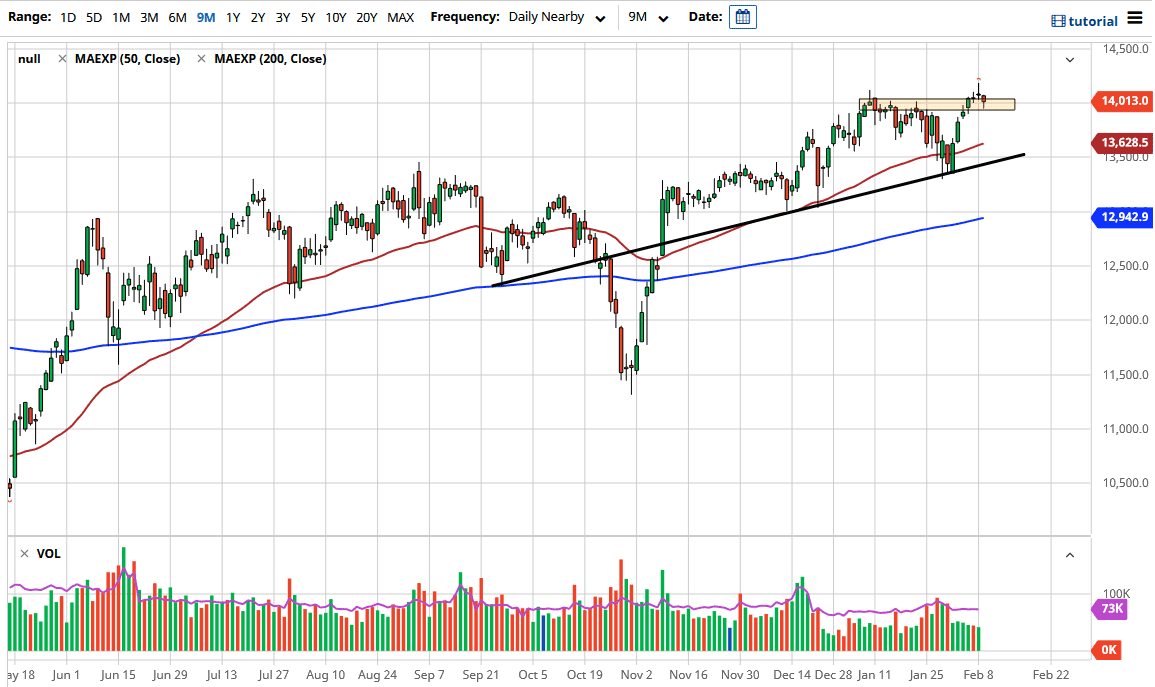

The DAX Index initially dipped during the trading session on Tuesday but found enough support underneath the 14,000 level to turn things around. This candlestick is preceded by a shooting star, so it shows that we are trying to break out to the upside. This is interesting, due to the fact that we eventually broke to the upside but found buyers coming back in to pick things up. The DAX is highly sensitive to exports coming out of the European Union and the overall economic health of that region.

Germany is Europe’s biggest economy, so it makes sense that the DAX would be the first place traders look to put money to work due to the fact that it is considered to be the “safest economy.” However, there are a few headwinds out there that could come into play, not the least of which is a strengthening euro. Recently, we had seen a little bit of a sell-off in the euro, but we now are starting to see some stability in that currency and that could lead to more stability here. The reasoning is that exports coming out of Germany will be either cheaper or more expensive based on the exchange rate.

If you are accepting the idea of the reflation trade, it does make sense that Germany would continue to show signs of strength, as there are major industrial exporters in that nation who are some of the biggest companies in the DAX. Because of this, it is very likely that we will continue to see some volatility. However, I think people will be looking to pick up the DAX every time it dips, not only because there could be massive demand for heavy industrial exports, but also because we are in a massive uptrend and, as currencies get devalued, there are a lot of people out there who will be looking to put money into various stocks. Germany is one of the first places traders look in Europe, and then they tend to fan out after that and put money in the places like Spain and Italy. I think this continues to be the “safe trade” in the European Union.