The DAX index gapped higher to kick off the trading session on Monday, which has been very bullish for stocks in general. After all, the other indices that I follow had also been very strong. For example, the Nikkei 225 kicked off the day rather significantly, and then the CAC in Paris and the FTSE 100 also shot higher. In other words, everybody was in a good mood during the day as the “reflation trade” is coming back into vogue.

With that in mind, stocks around the world got a bit of a boost. Furthermore, the DAX is the first place that people throw money at when it comes to the European Union, so it makes sense that the “blue-chip stocks” would rally. Dips will continue to be bought, especially as the DAX is so heavily influenced by exporters. In other words, if the global economy is going to warm up, then the Germans will be exporting massive amounts of industrial goods to countries not only in the European Union, but also the rest of the world.

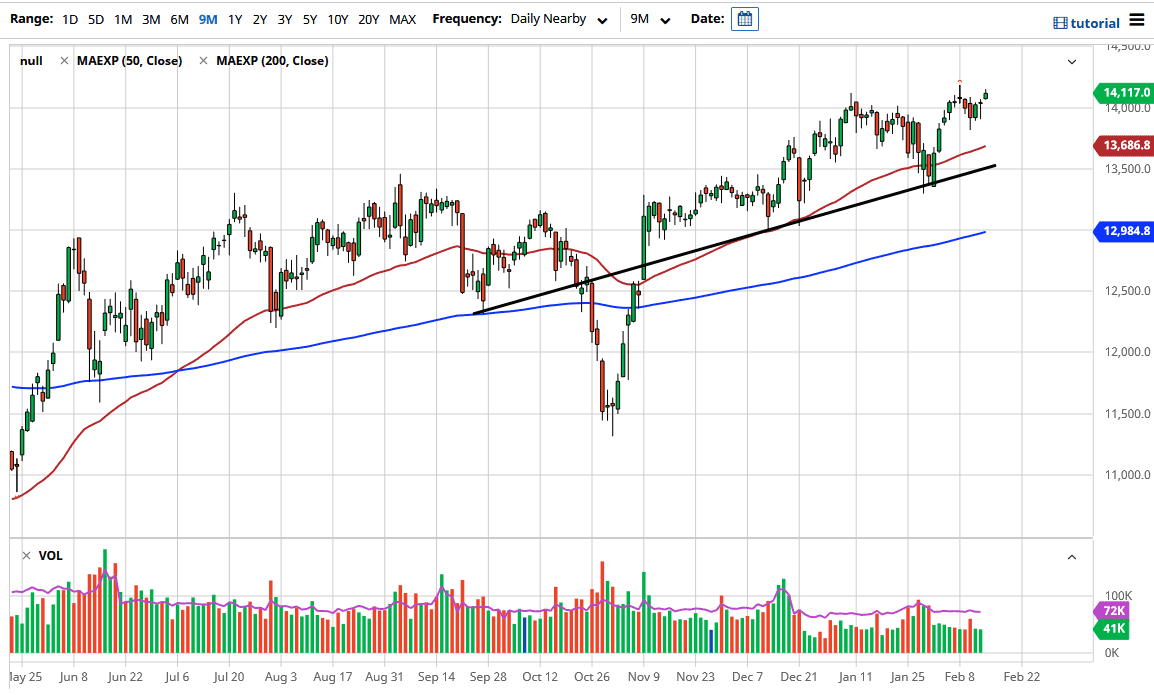

Nonetheless, the market is likely to see a lot of buyers on dips, just as we see in other stock indices around the world. The 50-day EMA underneath sits at the 13,686 level, and we have the uptrend line which is at roughly 13,500 below there. I think the market will find plenty of buyers between here and there, so looking for some type of support will be the best way to get involved going forward. However, if we break above the shooting star which formed the high last week, then that also sends the DAX much higher. I do not have a scenario in which I am willing to short this market, as stocks have been on a bullish run for quite some time, not only in Germany, but also the rest of the world. With the massive amounts of liquidity out there, stocks will only go up over the longer term. To the upside, I suspect that the market will go looking towards the 14,500 level, and then possibly even the 15,000 level after that. This does not mean that we will take off to the upside immediately, but I certainly think dips at this point have to be thought of as potential buying opportunities.