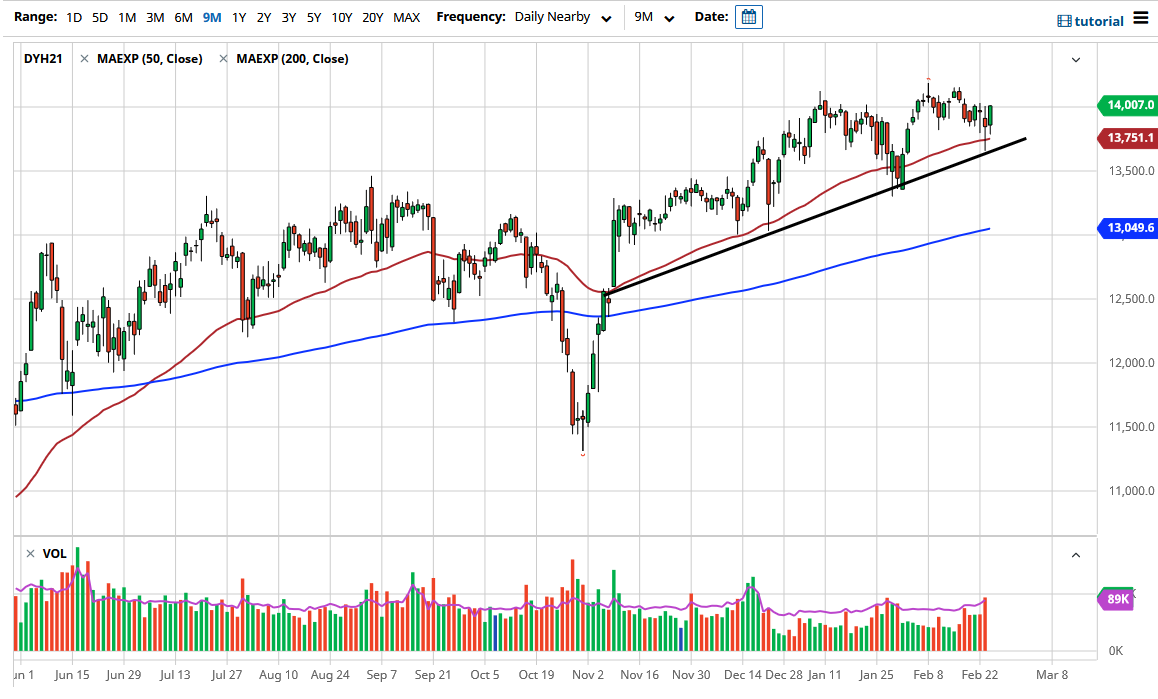

The DAX Index broke the 14,000 level during the trading session on Wednesday, which is a very bullish sign. We had formed a massive hammer during the trading session on Tuesday that has now been challenged at the very highest. Because of this, it looks as if the market is ready to continue going higher, with the initial target being the 14,250 level. After we break above there, then it opens up the possibility of a move to the 14,500 level, followed by the psychologically important and structurally impressive 15,000 level. That has been my target for a while, and I do think that we will get there sooner rather than later.

The German index is highly sensitive to the idea of the “reflation trade”, which is to say that the economy opening up as Germany is so highly levered to exports and industrial components. The one thing that may be worth paying attention to is the exchange rate of the euro, but at this point it is still not a major problem that would dissuade people from buying German goods. Furthermore, you should probably also keep an eye on the potential of rolling lockdowns, but one would have to think that sooner or later we would get enough vaccinations in Europe to put those in the past.

To the downside I see the 50-day EMA as offering support just above the uptrend line that I also have marked on the chart. In other words, there are at least a couple of barriers for sellers to overcome before they can make any serious dent in the uptrend. I think that buying dips will continue to work going forward, and the action of the last couple of days should do quite a bit to keep the buyers happy. After all, we did try to break down rather significantly on Tuesday but repelled all of the selling pressure to turn around just slightly negative. The fact that we are above that level now also suggests that we are ready to continue going higher at the slightest provocation. The momentum may have slowed down on the last couple of rallies, but we are still very bullish-looking and, with the cheap and easy money flying around the world right now, it is difficult to short stocks anywhere.