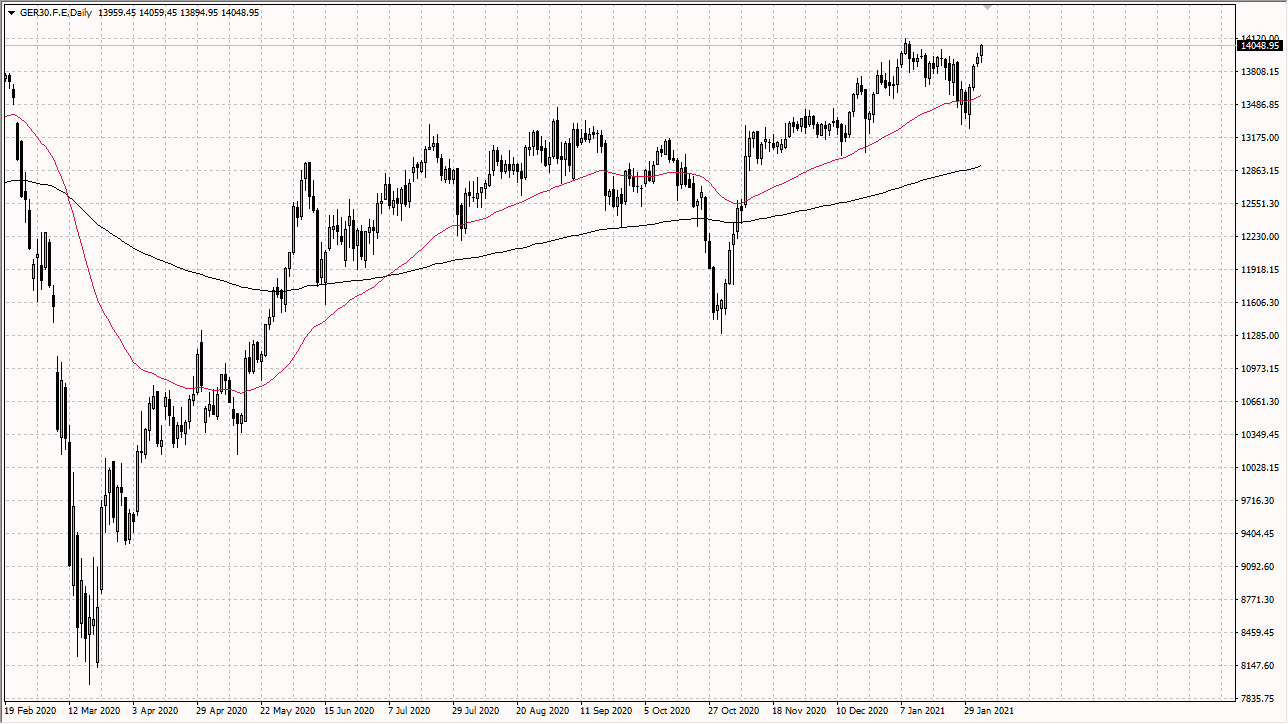

The German index has initially pulled back during the trading session on Thursday but continues to see bullish pressure, perhaps due to the fact that the Euro is losing strength. This drives up the demand for German exports as they become cheaper around the world. That being said, it is the same story that we have in places like Wall Street where all they care about is loose monetary policy.

Germany will be especially sensitive to this type of monetary policy due to the fact that the German economy and more specifically the DAX, is so heavily influenced by the exporters. That being the case, the market should continue to enjoy the fact that the Euro is losing strength. That being said, if we can break out to a fresh, new high, roughly 100 points above, then the market could extend its gains yet again. However, it is worth noting that the market had been rather parabolic over the last four days, so we may run out of momentum in the short term. Nonetheless, this shows that there is more than enough bullish pressure to send this market higher over the longer term.

It is also worth noting that the market has bounced from the 50 day EMA which of course is a technical indicator that a lot of people pay attention to. Friday could be a bit quiet though, because it is Non-Farm Payroll in the United States, which will cause a lot of volatility in general. Ultimately, this is a market that I think is bullish in general and should continue to be for the foreseeable future. Central banks around the world continue to flood the markets with liquidity, and I think that is going to be the main story not only here but most of the indices around the world. Furthermore, there are hopes that eventually the vaccine being distributed should continue to open up the economy as well, and therefore drive up economic gains. That being said, you should keep in mind that the DAX is considered to be the “blue-chip index” when it comes to the European Union, and it makes sense that a lot of the heavy industrial names in Germany would get a bid, as we are looking at a potential reflation situation. Regardless, I have no interest in shorting this market anytime soon and look at pullbacks as value.