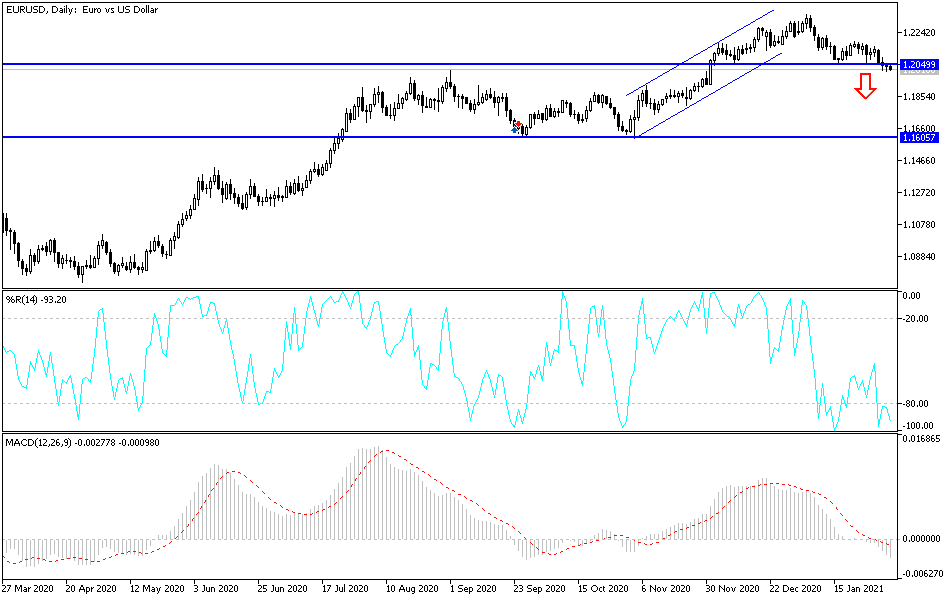

The euro fell initially during the trading session on Wednesday to reach down towards the psychologically important 1.20 level. We have bounced from there, albeit very slightly. The question now is what happens next, as we are testing an area that certainly will capture a lot of attention going forward. I do think that there is a significant amount of support between the 1.20 level and the 1.19 level underneath, so to break down below the 1.19 level I believe that we will have to see the US dollar breakout rather significantly. This is not to say that it cannot happen, just that it is going to take a bit more effort than we have seen over the last couple of days.

The shape of the candlestick is somewhat of a hammer, but it does not necessarily have a very long body, so I would not read too much into it. In fact, you can make an argument that this market is simply falling asleep, as we have the jobs number coming out of the United States on Friday, and perhaps people are a bit skittish about putting a lot of money to work between now and then. If that is the case, it makes sense that we would not break down below the 1.20 level, despite the fact that a lot of the economic numbers out of the European Union have been less than impressive lately. Furthermore, the European Union also has to worry about the idea of a slower-than-anticipated vaccine rollout, which will certainly have an influence on how the economy performs.

With all of that in the back of our minds, we need to look at this from a pragmatic point of view. A bounce from here does make sense, but it also makes sense that perhaps the 1.2150 level could cause a bit of resistance, as we have broken down from there recently. I think what we are seeing here is a little bit of profit-taking as we head towards the end of the week, which will feature that non-farm payroll announcement that so many people pay close attention to. For what it is worth, the ISM Non-Manufacturing figures came out during the day better than anticipated, and the service sector is roughly 2/3 of the US economy, so that is something that could add a little bit of strength to the greenback.