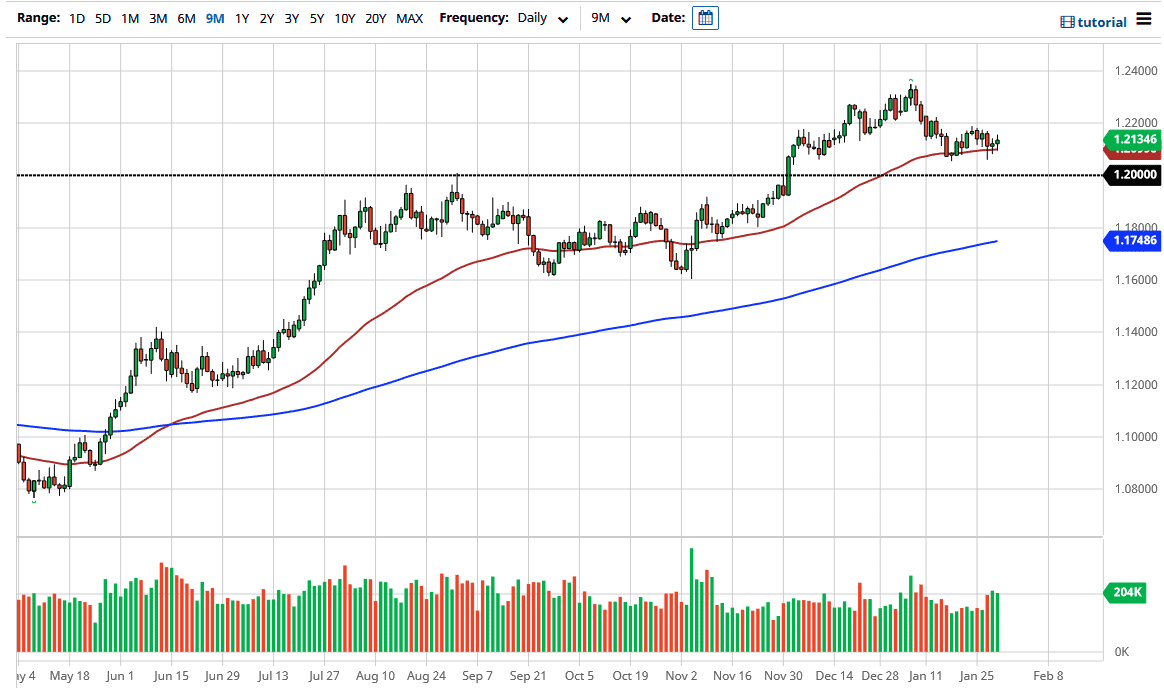

The euro continues to fluctuate overall, as we are simply riding along the 50-day EMA. The 50-day EMA is a fairly important technical indicator that longer-term traders pay attention to. The 1.21 level extends down to at least the 1.20 level for support. If we were to break down below the 1.20 level, it could open up fresh selling at that point.

On the other hand, it would not surprise me to see this market bounce from here, perhaps reaching towards the 1.23 handle. The 1.23 level was significant resistance previously, and when you look at the weekly chart, we had formed a massive shooting star, only to break back down. Now it looks as if the hammer from the week that we just finished suggests that we could turn around and challenge that level again. This is all about the US dollar, and probably not so much about the euro. The market is likely to continue to see a lot of back and forth in the meantime, as we have such significant barriers on both sides of the trading right now.

I think that a lot of people will play the euro on short-term charts, so it is important to be cautious about your position size and pay attention to the fact that it will continue to be very choppy and volatile. However, the euro is typically very noisy, and that continues to be the main way this market behaves. At this point, the market is likely to continue to see a lot of choppy behavior, so I think you should probably be quick to take your profits if you are involved. If you are looking for a bigger move, good luck, because it is unlikely to happen anytime soon. However, if we do finally break out, we could go as high as the 1.30 level over the longer term. That would need to see stimulus moving forward, and perhaps bigger than the market is trying to price in. There is a lot of noise out there as per usual, and the euro is a perfect extrapolation of that.