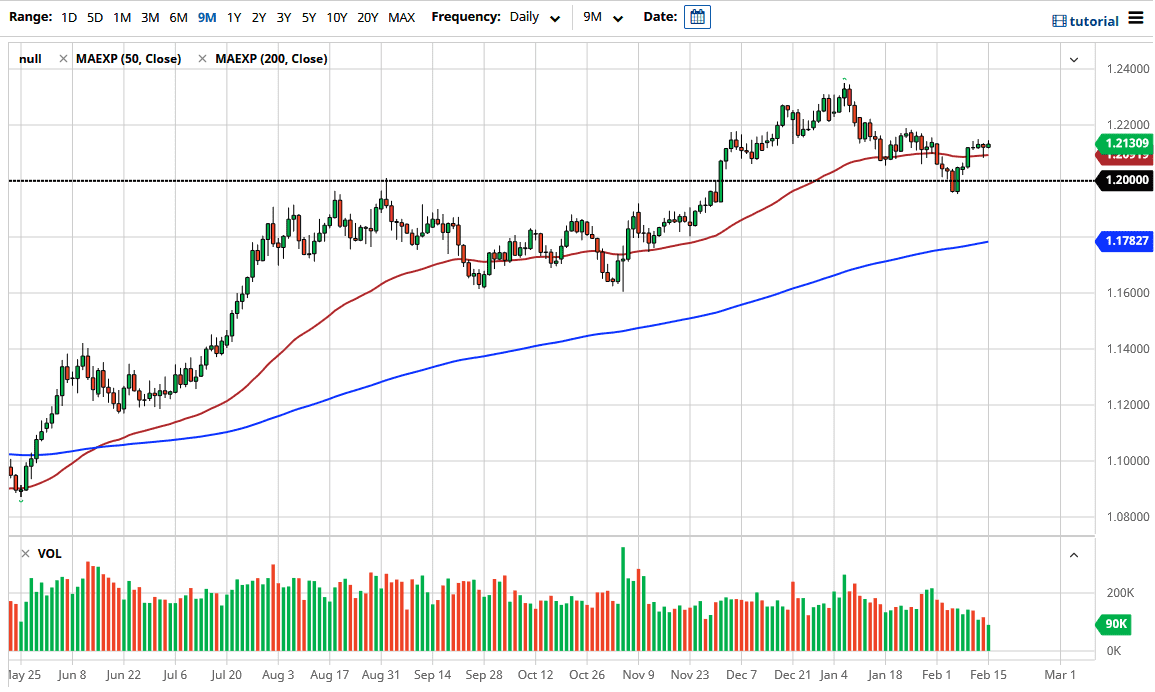

The euro continues to be rather sideways in general, as we gained ever so slightly during a quiet session on Monday. The Americans were away celebrating President's Day, so there was a certain amount of liquidity taken out of the market. As the British went home, the markets died. Nonetheless, we are sitting in an area that has been important for several days now, so it should not be a huge surprise that we are just basically hanging around and killing time.

I believe the 50-day EMA underneath should offer support, just as the one point to zero level should. In fact, I believe that there is significant support underneath the 1.20 level that extends all the way to the 1.19 handle. It is not until we break down below there that I think that the euro is in any serious trouble. After all, we have the stimulus package in the United States that looks likely to pass, and this could but downward pressure on the US dollar.

However, you should also keep in mind that the European Union has been stagnating to say the least, so one would have to wonder whether or not the euro should be punished as a result. In a normal market you would say yes, but now that we are solely looking at liquidity more than anything else when it comes to risk assets, it can cause very strange reactions. Currently, I believe that the 1.23 level above is massive resistance, extending to the 1.25 handle. I believe that we will probably eventually try to rally and reach that region, but it might be rather choppy between now and then. It is just going to depend on what the market is focusing on that particular day, be it coronavirus figures in the European Union and the lockdowns, or massive amounts of stimulus coming out of Washington DC. This is one of the biggest problems with trading this pair: the markets have ADD and both of these are major currencies. Essentially, if you are looking for bigger moves this is not where you want to be. If you are a short-term range-bound trader, then you may look at this chart as one that is somewhat appealing in that particular trading scenario.