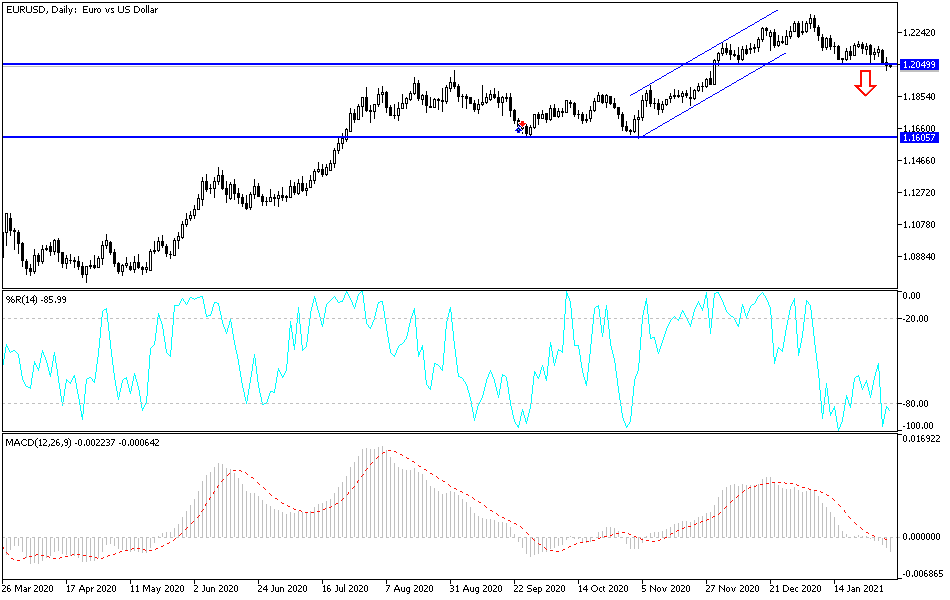

The euro initially tried to rally during the trading session on Tuesday but found the 50-day EMA to be a bit too resistive to continue going higher. The market is very likely to reach down towards the 1.20 level, which is sitting just below. That is a large, round, psychologically significant figure and it makes sense that we would see a bit of a reaction in that area.

Beyond that, I believe the 1.20 level being broken to the downside kicks off an attack on significant support all the way down to the 1.19 level. If we can break down below there, I think that we could go looking towards the 200-day EMA. On the other hand, if we were to turn around and show signs of strength, then I think the 50-day EMA is your initial barrier that you need to overcome.

The European economy is starting to sputter a bit, and I think that is part of what we are seeing here. The euro shot straight up in the air, but at the end of the day, it is very much overdone at this point, and I believe that another part of what we are seeing here is the US dollar recovering just a bit. To the downside, the market could go as low as the 1.18 level after that, looking towards the 200-day EMA. The US dollar is picking up strength due to a whole host of reasons, one of which would be that stimulus may be smaller than anticipated, so we may have to “re-price the dollar.” If that is the case, then we again are far overdone.

The 1.23 level above is significant resistance that I think extends to the 1.25 handle. I believe that is going to be a very difficult level to get beyond, and that it offers massive problems for the buyers. In that sense, I suppose it is easier to break down than it is to break up, but regardless, this is a market that is likely to be more range-bound with a slightly negative bias going forward. I would keep my position size somewhat small in this type of noise.