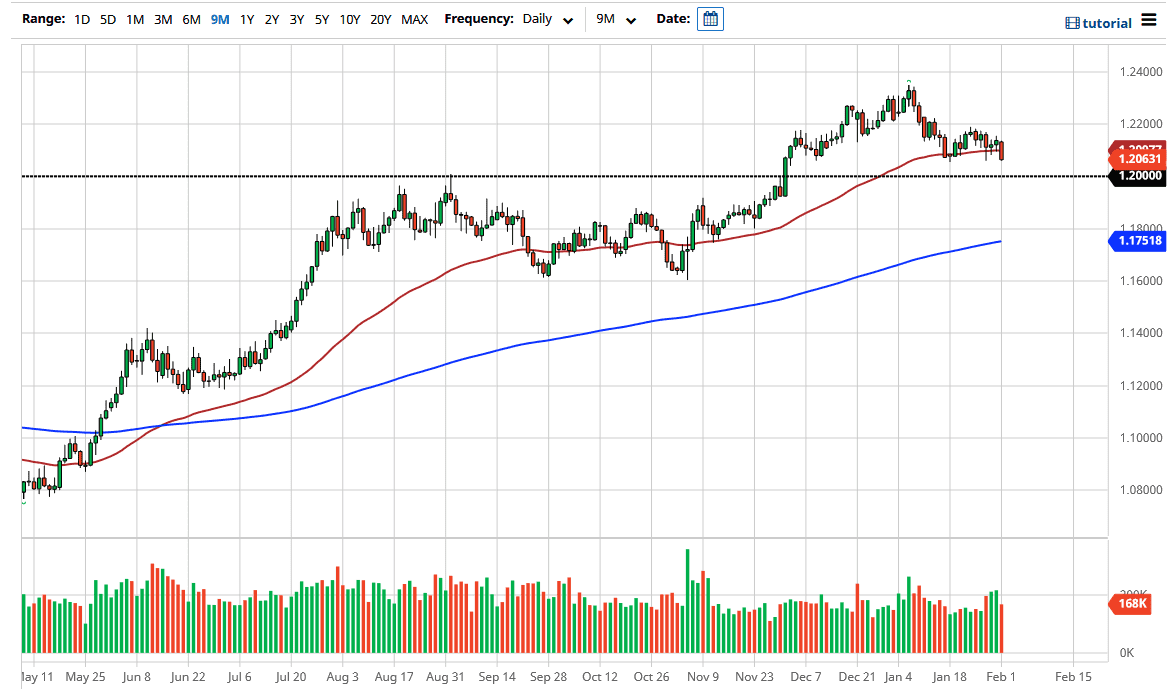

The euro broke down significantly during the trading session on Monday to reach down towards the 1.2050 level yet again. This is an area that was tested a couple of times last week, and the fact that we are closing towards the bottom of the candlestick does suggest that we have further to go to the downside. The 1.20 level underneath probably continues to be massive support as it is not only a large, round, psychologically significant figure, but it is also the scene of a major breakout previously. In other words, there is probably a certain amount of “market memory” to be found in this general vicinity, ss that it probably where the market is going to reach in order to test it again.

The market probably has support down to at least the 1.19 level, so I would keep that in mind as well. I do not think that we are going to see a massive amount of selling pressure or a major breakdown, so we probably will have a bit of a bounce given enough time. However, if we were to break down below the 1.19 level, I think things would suddenly take a relatively ominous tone.

To the upside, I believe that the 1.22 level continues to offer resistance, and most certainly the 1.23 level will. There are massive amounts of resistance all the way to the 1.25 handle, so at this point I do not have any interest in trying to get long once we breach the 1.23 level, but if we break above the 1.25 handle, then I think the longer-term trend would continue to go much higher, as it would be a major break of massive resistance.

Currently, I suspect that we are more or less going to be in a bit of a range-bound market, so we are looking at a scenario in which you are trading short-term charts only. However, if we finally do break out of the 300-point range that we are roughly trading in, that could change things. Stay tuned; I will let you know when I see something that gives us a bit of confidence in one direction or the other. But until then, I will simply be trading back and forth.