The euro rallied again on Monday as we seem to be lacking any real decisive action yet again. This pair tends to be choppy, so this latest move should not be a surprise. One day, it will be ‘pro-dollar’, followed by the exact opposite. Unfortunately, I do not see a sign that the market is about to clear the confusion up. The market continues to trade between 1.20 and 1.23 in general, and I think that is where we are stuck for the time being.

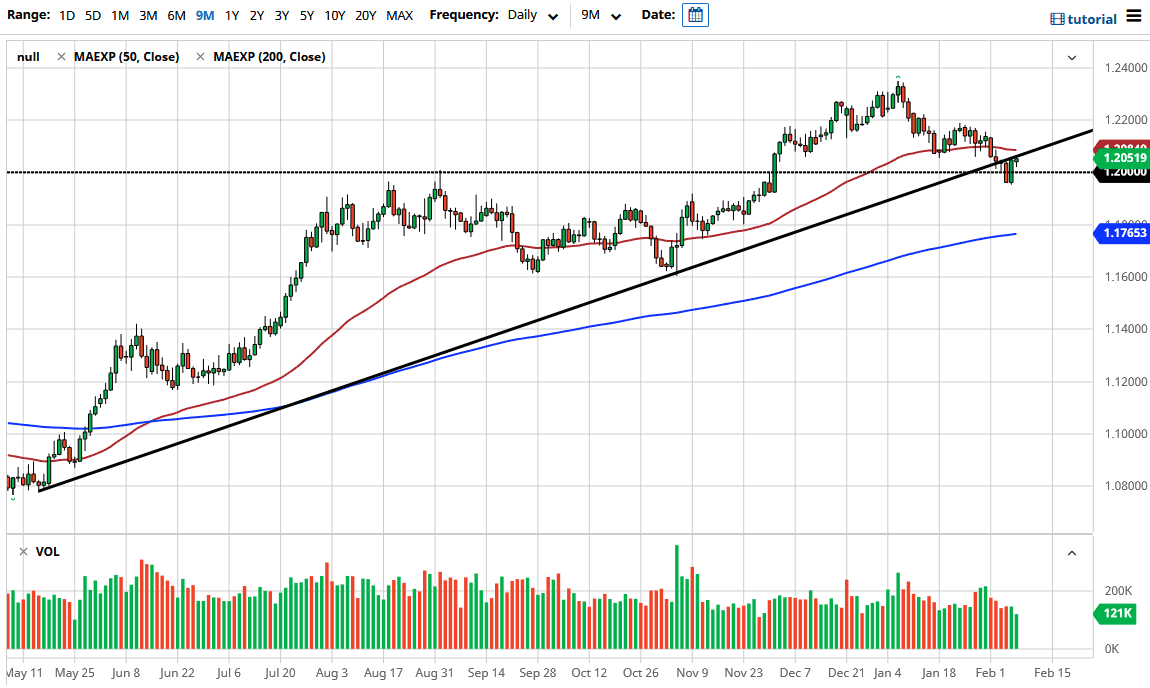

The euro initially fell during the trading session but finds support just above the 1.20 level, and looks as if it is pressing this uptrend line. The uptrend line breaking above there and then reaching towards the 50-day EMA would be a big deal, just as breaking above it could be. This is a great pair to frustrate traders, but if we break down below the bottom of the candlestick from the session on Monday, then I begin to wonder whether or not we are going to break down rather significantly, as breaking through that uptrend line is somewhat important.

If we break above the 50-day EMA, then we probably go looking towards the 1.22 handle. That is an area that has seen a significant amount of resistance as well, so we are likely going to see a lot of choppiness and uncertainty, especially as we dance around the 50-day EMA, which does tend to cause a lot of noise. On the other hand, if we do break down bit, it is likely that we will go looking towards the 1.1765 handle, which is where the 200-day EMA is currently sitting. I think there will continue to be a lot of noisy trading, so I would be very cautious about putting money to work. I would actually wait to put any money to work due to the fact that we will probably get some type of significant move, and you will be much better off simply waiting for the market to tell you which direction it is going to follow. I would wait for a daily close either above that 50-day EMA, or a daily close below the lows on Friday.