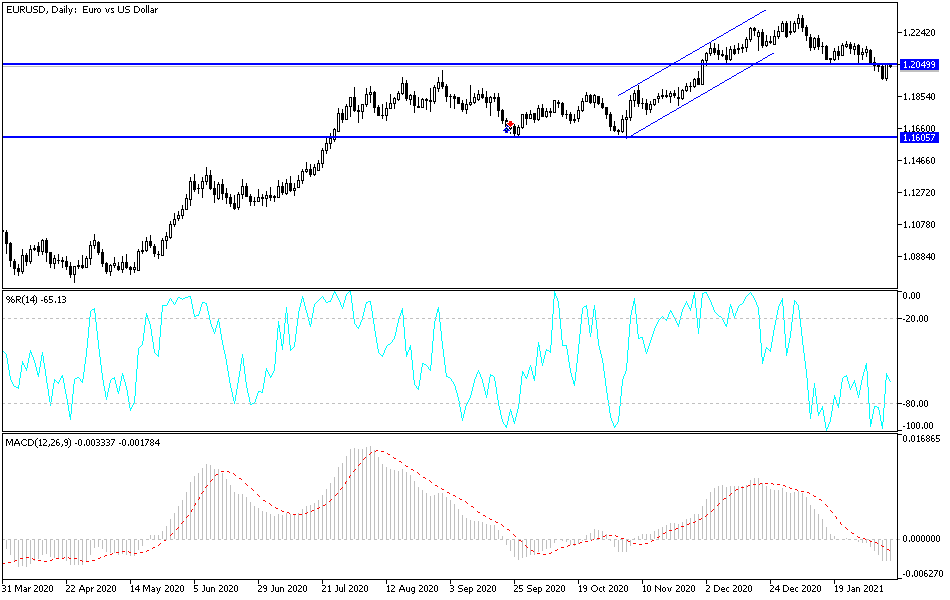

The euro rallied rather significantly on Friday to wipe out all the losses from Thursday. It looks as if we are ready to dance around the 1.20 level, an area that I think is important for the market, but you should also note that the 50-day EMA is sitting just above and could cause a little bit of resistance. At this point, it looks like we are trying to price in the idea of massive amounts of stimulus coming out the United States, so it is not a huge surprise that people came back into the euro overall. The jobs report was probably a big factor as well, as the United States added only 49,000 jobs in the month of January which, while being a bounce from the December report, was not enough to get people extraordinarily bullish the US economy.

When you look at the overall trend, it has been very strong, but it does also look like we are getting a bit exhausted in general. Yes, this was a strong green candlestick, but when compared to the last 10 days or so, you can see how it was simply just a “blip on the radar.” It is because of this fact that I am not jumping into this market from the blind side quite yet. Furthermore, you have to worry about the European Union and its economic numbers shrinking while the US continues to produce better-than-anticipated numbers overall.

It is worth noting that we are closing towards the top of the range, so we may have a bit further to go to the upside. But at this point, I believe that we are going to see more choppiness. In other words, I think that we could get a little bit of a bounce, but I would not get overly aggressive at this point, even if you are extraordinarily bullish on the Euro in and of itself. I anticipate that if you are looking to short the US dollar, you can probably find better currencies to do it against, as the European Union has a whole plethora of issues when it comes to its economy, as well as the rollout of the vaccine, something that traders are starting to factor into their trading models.