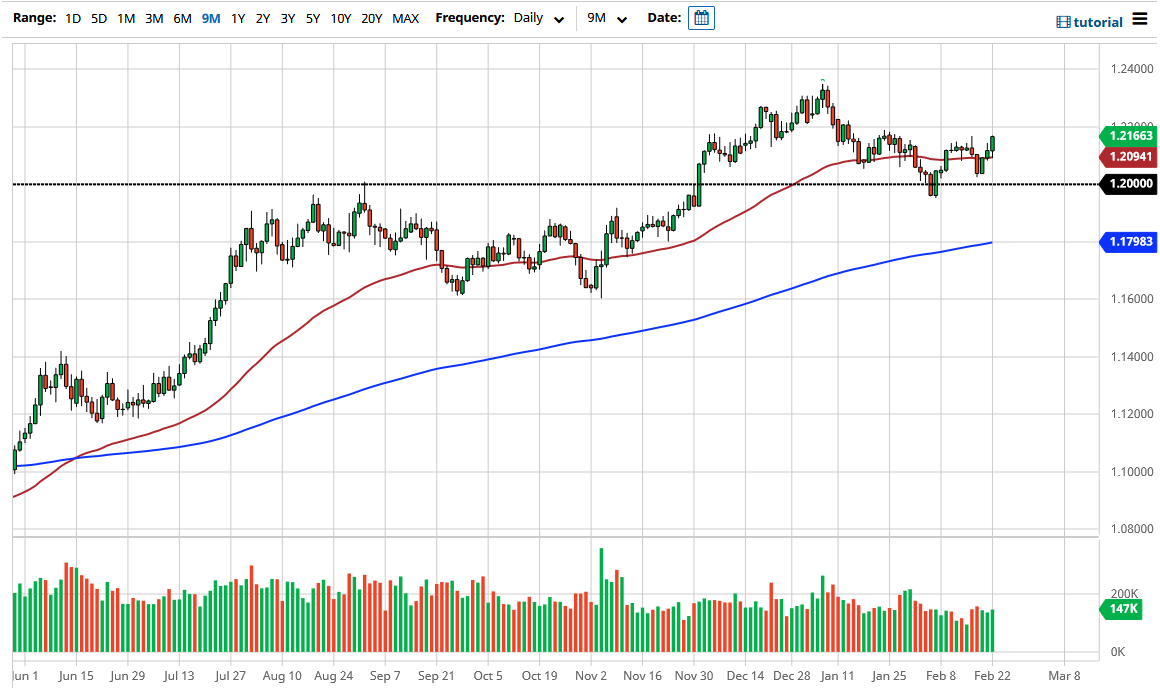

The euro rallied again during the trading session on Monday, showing signs of strength. We are closing closer to the top of the candlestick then we have been able to recently, and there is also a bit of a small “inverted head and shoulders” that has started to form. If we can break out above the 1.22 handle, then it could measure for a move to the 1.24 region, although I would not expect much more than that due to the massive amount of resistance above the 1.23 handle.

The pair does tend to be very noisy, because there are a multitude of things to keep in the back of your mind when trying to trade these two currencies against each other. The European Union continues to suffer at the hands of extended lockdowns, which shuts down the ability of the economy to grow. However, on the other side of the Atlantic Ocean, you have the Americans getting ready to pump out a massive amount of stimulus that works against the value of the greenback.

The 50-day EMA is flat and sitting underneath the candlestick for the trading session, so I think this shows just how nonchalant this market is right now as far as momentum is concerned. I think we are going to see a lot of back and forth, but even if we do break out to the upside, I think it will be somewhat limited. A break above the 1.22 handle is a good sign, but I think that regardless of what happens next, we are going to see a massive amount of volatility and choppiness.

One thing to pay attention to will be the 10-year note, because it has started to see a significant amount of strengthening when it comes to yields, and if that continues to be the case, it does make the US dollar a bit more attractive. During the trading session on Monday, we had seen yields drop, so it all fits together quite nicely, at least over the last 24 hours. One thing I think you can count on is a lot of choppy and sideways trading in general, so this is going to be a short-term trading type of environment.