Bullish Case

Set a buy stop at 1.2180 (above yesterday’s high).

Add a take-profit at 1.2250 and a stop loss at 1.2130.

Bearish Case

Set a sell-stop at 1.2130 (lowest level yesterday).

Add a take profit at 1.2080 and a stop loss at 1.2160.

The EUR/USD is in a tight range ahead of the second reading of the German fourth-quarter GDP and US new home sales numbers. The pair is also reacting to the first testimony by Jerome Powell.

German GDP Data Ahead

The EUR/USD price has moved sideways recently as investors react to the rising treasury yields in the United States. The yield on the ten-year note rose to 1.36% while that of the 30-year rose to 2.17%, the highest it has been in more than a year.

In his testimony yesterday, Jerome Powell talked about the recent performance in the bond market. He said that the rising yields were evidence that investors were getting more confident about the US economy.

Nonetheless, he said that the Fed would keep its pandemic response tools unchanged in the near term. This means that the bank will leave interest rates unchanged at near zero and continue with its monthly $120 billion purchases of government-backed bonds.

Later today, Powell will testify in front of another congressional committee. However, today’s meeting will likely not have a major impact on the US dollar.

The EUR/USD will react to the latest GDP data from Germany. In the second reading, analysts expect the numbers to show that the economy increased by 0.1% in the fourth quarter. This will lead to an annualised decline of 2.9%. Still, unless there is a major change, the second reading will not have a major impact on the currency.

The Department of Commerce will publish the latest new home sales numbers. Economists expect the data to show that sales rose by 2.1% in January. This will be the second consecutive month of gains after the sales rose by 1.6%.

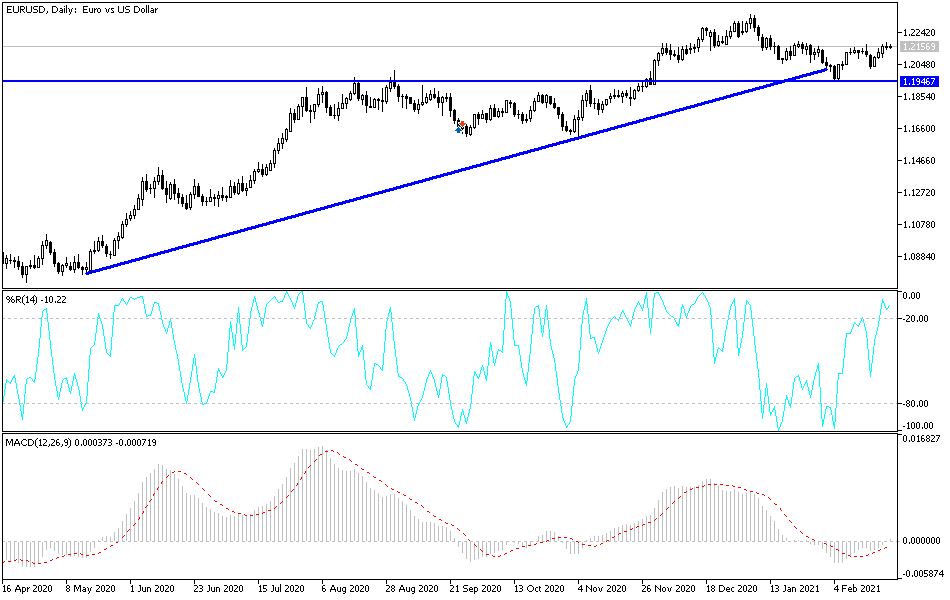

EUR/USD Technical Outlook

The EUR/USD price has been in a tight range in the past few days. It has found some substantial resistance at 1.2180, which was the highest level yesterday. It also between the middle and upper line of the Bollinger Bands and slightly above the 25-day moving average and the Ichimoku cloud. Most importantly, the pair has formed an ascending triangle pattern. Therefore, there is a possibility that it will soon break-out higher as bulls target the resistance at 1.2200.