Bearish signal

Short the EUR/USD at 1.2130.

Have a take profit at 1.2082 (lower side of the channel).

Add a stop-loss at 1.2200.

Bullish signal

Have a buy stop at 1.2200.

Add a take-profit at 1.2250 and a stop-loss at 1.2150.

The EUR/USD is wavering today ahead of key economic numbers from the European Union and the United States. It is trading at 1.2130, where it ended last week.

EUR/USD Wavers Ahead of PMI Data

The EUR/USD pair will today react to several important numbers from Europe and the US. The main numbers will be the final Purchasing Managers Index (PMIs) by Markit and the Institute of Supply Management (ISM).

In general, based on the flash PMIs released earlier, these numbers will likely be weak because of the new wave of coronavirus and the lockdowns ordered by many governments. In Europe, the consensus is that the manufacturing PMI dropped to 54.3 in January. In Germany, the PMI likely dropped to 54.7 while in France, it dropped to 51.5. Still, the manufacturing sector has done better than the important services industry.

The EUR/USD will also react to the German retail sales numbers that will come out at 07:00 GMT. Economists expect the data to show that sales dropped by 2.6% in December leading to an annual increase of 5.0%. Other important numbers from Europe will be car registrations and GDP data from Sweden.

Meanwhile, in the United States, Markit and the IS will publish the Manufacturing PMI numbers. Further traders will watch the happenings in social media platforms like Reddit and Discord that are driving action in the stock market. Higher volatility in stocks like GameStop and Nokia will likely lead to a stronger dollar because of the rising risks.

EUR/USD Technical Outlook

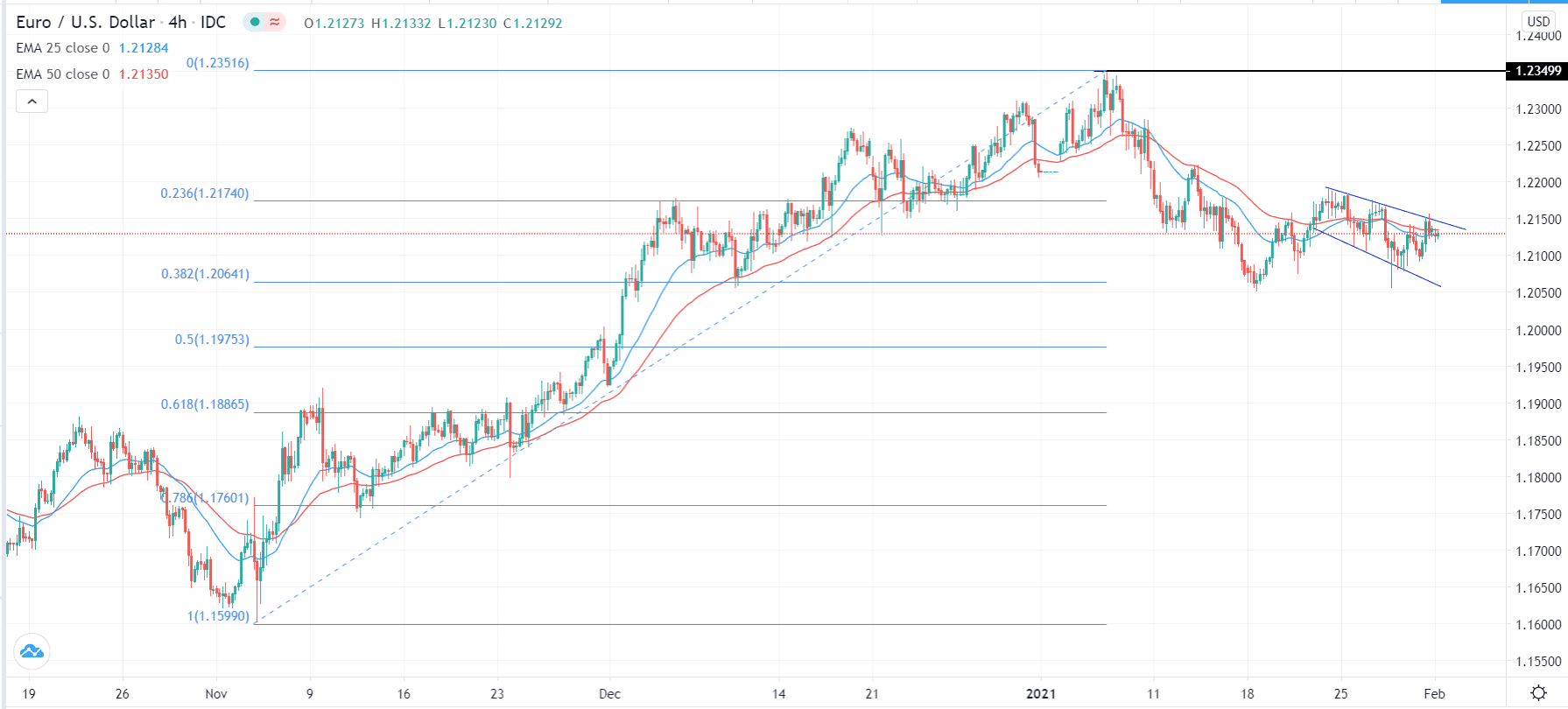

Last month, the EUR/USD pair dropped from the year-to-date (YTD) high of 1.2350 to 1.2052. After that, the pair bounced back but found a substantial resistance at 1.2190. Today, it is trading at 1.2130, which is on the same level as the 25-day and 50-day exponential moving averages (EMA). It has also formed a descending channel that is shown in blue. Today, it is close to the upper side of this channel.

Therefore, there is a possibility that the pair will resume the downward trend as bears target the lower side at 1.2130. This prediction will be invalidated if the price manages to move above the upper line of the channel and the 23.6% Fibonacci retracement level.