Bearish Signal

Sell the EUR/USD below 1.2168.

Add a take-profit at 1.2050 and a stop-loss at 1.2250.

Bullish Signal

Set a buy stop at 1.2170.

Add a take-profit at 1.2250 (median of the pitchfork).

Set a stop-loss at 1.2100

The EUR/USD retreated yesterday helped by a relatively strong US dollar. The pair declined from a three-week high of 1.2070 to a low of 1.2087.

US Dollar Strength

After weeks of declining, the US dollar bounced back yesterday after US treasury yields rose as traders bet on a strong US recovery and higher inflation. Yields on the ten-year government bonds rose above 1.30%, their highest level since March.

This performance is mostly because investors have started to price-in another large stimulus from the US. Already, Congress is compiling a $1.9 trillion package that will provide more funding for vaccine distribution and offer more stimulus checks.

As a result, investors believe that this package will spur inflation, forcing the Federal Reserve to start tightening faster than expected. Last week, data by the US government showed that the headline Consumer Price Index rose by 1.4% in January, the fastest increase in five months. As such, some analysts believe that this inflation will rise to 2.0% by the end of the year.

The EUR/USD dropped even after some encouraging economic numbers from Europe. In a report yesterday, the European statistics agency said that the economy contracted by 5.0% in the fourth quarter. That was a better than the initial update of a 5.1% contraction.

Later today, the pair will react to the European Central Bank (ECB) monetary policy statement and the EU construction output. The most important numbers of the day will be the US retail sales numbers and Producer Price Index. In general, economists expect that the US retail sales rose by 1.1% in January after slumping by 0.7% in the previous month. Also, they see the headline PPI rising by 0.9%.

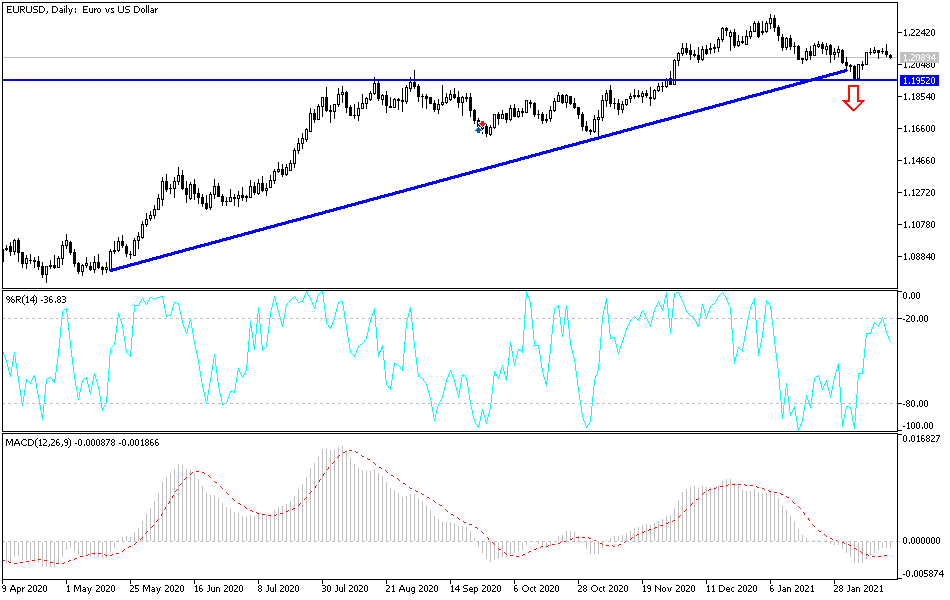

EUR/USD Technical Outlook

The EUR/USD reversed sharply after reaching a high of 1.2168. Notably, this level was along the first support level of the Andrews pitchfork tool. It was also a level where the pair found some resistance on January 25. The price has also moved below the 25-day and 15-day exponential moving averages (EMA). Therefore, the pair will remain in a bearish trend so long as it is below this Andrews Pitchfork support. The next key level to watch is 1.2050.