Bullish View

Set a buy stop trade at 1.2130 and a take-profit at 1.2150.

Add a stop-loss at 1.2100

Bearish View

Set a sell-stop at 1.2120 and a take-profit at 1.2080.

Add a stop-loss at 1.2150.

The EUR/USD is little changed as traders digest the recent EU and US economic numbers and look forward to the ongoing stimulus talks. The pair is trading at 1.2120, which is in the same range where it ended the week.

Muted Economic Calendar

Last week, the EUR/USD reacted to several important economic numbers from the US and the EU. The US published the housing starts, new home sales, and retail sales numbers. It also delivered relatively weak initial jobless claims data.

On Friday, we received robust Manufacturing and Service PMI numbers from the two sides. In the United States, the Manufacturing PMI declined from 59.2 to 58.9 while the Service PMI increased from 58.3 to 58.9. Similarly, in the European Union, the two PMIs increased to 57.7 and 48.1, respectively.

This week, the economic calendar will be relatively muted. Today, the Ifo Institute will publish the latest business climate and current assessment data from Germany. In general, economists expect better numbers as the vaccination process continues.

On Tuesday, Eurostat will publish the latest inflation numbers from the European Union. Economists expect the data to show that the headline CPI rose by 0.9% in January while the core CPI rose by 1.4% in January. Other notable numbers from Europe will be the services and industrial sentiment figures that will come out on Thursday.

The EUR/USD will react to the US GDP and durable goods data that will come out on Thursday. It will also react to the latest consumer confidence data by the conference board and a speech by Jerome Powell.

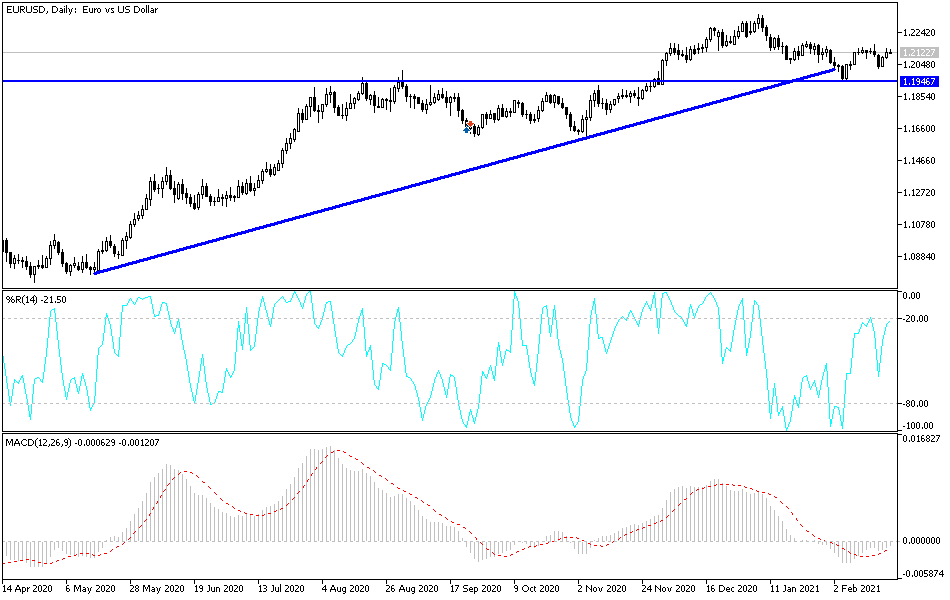

EUR/USD Technical Outlook

The hourly chart shows that the EUR/USD has been wavering in the past few hours. The pair is at the same level as the 25-period and 15-period weighted moving averages. Notably, it seems to be forming a bullish pennant pattern that is shown in red. Therefore, the pair may rebound in the near term as bulls attempt to move above the resistance at 1.2143. However, a break below 1.2100 will invalidate this trend.