Bearish signal

Sell the EUR/USD and put a take-profit at 1.1950 (Friday low).

Add a stop-loss at 1.2110 (first Andrew Pitchfork support).

Timeline: 1-3 days.

Bullish signal

Set a buy-stop at 1.2110 and a take-profit at 1.2175 (23.6% Fibonacci retracement).

Add a stop loss at 1.2050.

The EUR/USD is holding steady after bouncing back by about 0.90% on Friday after the relatively weak US employment numbers. The pair is trading at 1.2035, which is slightly below Friday’s high of 1.2055.

Weaker US Dollar

The weak US dollar is the main theme today. The US Dollar Index has dropped by more than 0.70% since Friday after the weak US employment numbers. The currency has weakened against most developed world currencies like the euro, sterling and Swedish krona. It has also dropped by more than 0.70% since Friday.

The data showed that the US economy added about 49,000 jobs in January after shedding 140,000 in the previous month. On Wednesday, data by ADP revealed that private employers had added more than 140,000 jobs. As a result, there is an effort by the government to provide further stimulus in addition to the $900 billion passed in January.

This week, the EUR/USD will react to news on stimulus from the United States. Also, the pair will react to the important economic numbers from Germany, the biggest economy in Europe.

Today, the German statistics office will publish the latest industrial production figures and the Wholesale Price Index (WPI). Economists expect that the industrial production rose by 0.3% in January as the country continued to implement lockdowns. On Tuesday, the agency will deliver the German trade numbers followed by inflation data on Wednesday.

The EUR/USD will also react to the January inflation numbers. Economists expect the data to show that the US consumer price index (CPI) rose by 1.5% in January while the core CPI rose by 1.6%. Still, data in the bond market shows that inflation could rise sharply later this year because of the stimulus package.

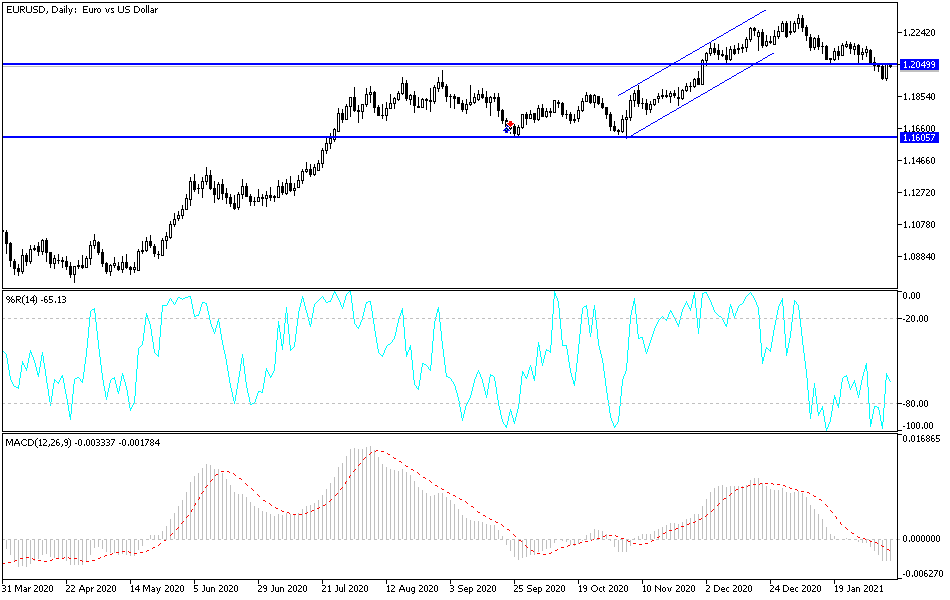

EUR/USD Technical Outlook

The four-hour chart shows that the EUR/USD is a few pips below the highest level on Friday. The price is also between the first and second support levels of the Andrew Pitchfork. It is also slightly below the 38.2% Fibonacci retracement level and a few pips above the 25-day EMA.

Therefore, the pair will likely remain in a bearish trend as long as it is between the two support levels of the pitchfork. As such, profit-taking will possibly see it retest Friday’s low at 1.1950. In the alternative scenario, the pair may rise as bulls try to retest the first support at 1.2110.