Bearish case

Set a sell stop at 1.2013 (overnight low).

Add a take-profit at 1.1975 (50% retracement).

Set a stop-loss at 1.2078 (25 WMA).

Bullish case

Set a buy-stop at 1.2078 and a take-profit at 1.2170 (23.6% retracement).

Add a stop-loss at 1.2010.

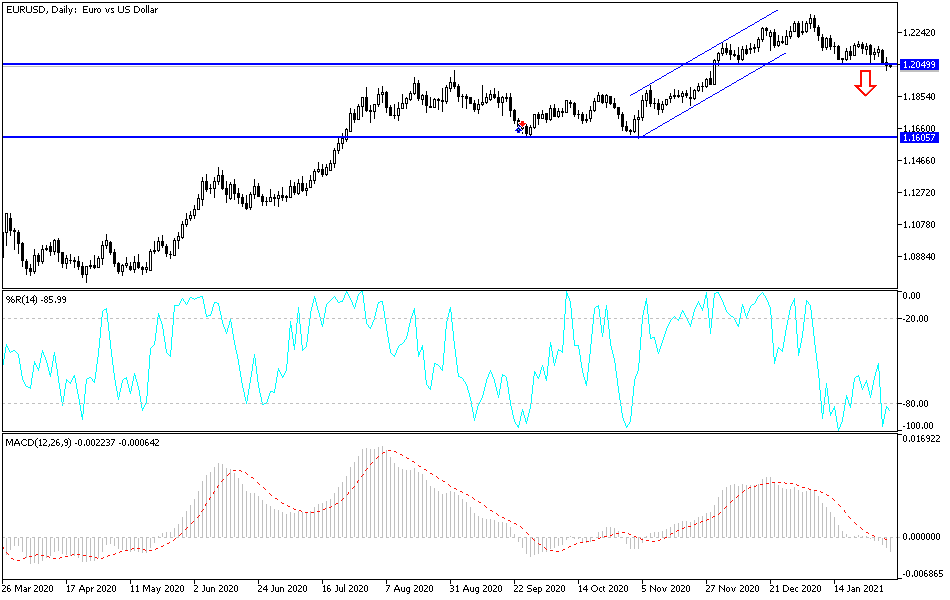

The EUR/USD declined sharply yesterday after the relatively weak EU GDP data and the overall US dollar strength. The pair reached a low of 1.2012 that is 2.7% below the year-to-date high of 1.2350.

Service PMIs Ahead

On Monday this week, data published by IHS Markit showed that the European manufacturing sector continued to flourish in January even as countries imposed lockdowns. The strong PMI figure was also partly because of lengthier supplier times because of these lockdowns and Brexit issues.

The story will likely be different today when the research firm publishes the Service PMI data. Economists expect that the EU PMI will drop to 45.0 mostly because many service providers like restaurants, tourism, and hotels were deemed as non-essential.

In Germany, the median estimate is for the PMI to drop to 46.8 while in Italy and France, the PMI is expected to drop to 39.5 and 46.5, respectively.

The EUR/USD will also react to the preliminary inflation data from Europe that will come out at 10:00 GMT. The headline Consumer Price Index (CPI) is expected to rise to 0.5% while the core CPI is expected to increase by 0.2%. These numbers are significantly below the European Central Bank (ECB) target of 2.0%. The Producer Price Index (PPI) is also expected to drop by 1.2%.

Meanwhile, there will be important economic data from the US as well. The Automatic Data Processor (ADP) will publish its estimated private payroll increase. Economists expect that US employers added just 49,000 jobs in January. This number will come out two days ahead of the official nonfarm payroll numbers. The ISM and Markit will also publish the US Service PMI.

EUR/USD Technical Outlook

The EUR/USD continued the downward trend it started on January 6. Overnight, it dropped to an intraday low of 1.2012, which is slightly below the 38.2% Fibonacci retracement level on the four-hour chart. The pair also moved below the Ichimoku cloud and the 25-period weighted moving average.

Therefore, it seems like bears have the momentum, which means that the pair will continue falling as they aim for the 50% retracement at 1.1975. However, the EUR/USD has also formed a bullish engulfing pattern, which signals a potential short-term rebound.