Bullish view

Set a buy stop at 1.2150 and a take-profit at 1.2200 (61.8% Fibonacci retracement level).

Add a stop-loss at 1.2100.

Bearish view

Set a sell-stop at 1.2100 and a take profit at 1.2050.

Add a stop-loss at 1.2150.

The EUR/USD price rose in early trading as investors looked ahead to a busy week in Europe and the United States. The pair rose to 1.2135, which is 0.45% above Friday’s low of 1.2080.

US Deficit to Widen Before Stimulus

The US dollar declined in early trading as investors continued to worry about US public debt as lawmakers in Washington continued to deliberate on the $1.9 trillion stimulus package by the Joe Biden administration. This package will allocate funds to households, companies, vaccine distribution, and state and local governments.

In a report published during the weekend, the Congressional Budget Office (CBO) said that the total US debt will move above the total US GDP for the first time in more than 50 years. This is mostly because of the $4 trillion in spending that the US government has unveiled in its attempts to deal with the pandemic.

The EUR/USD is also rising ahead of key economic numbers from both Europe and the US. Today, Eurostat will publish the bloc’s industrial production data. Economists expect that this production declined by 1.0% in December after rising by 2.5% in the previous month. This weakness will mostly be because of the lockdowns imposed by many European governments.

On Tuesday, the office will publish the second estimate of EU Q4 GDP data while the European Central Bank (ECB) will publish the latest monetary policy statement.

Meanwhile, US markets will be closed today for the President’s Day holiday. The key economic numbers to watch from the United States are the Producer Price Index (PPI), retail sales, and FOMC minutes that will come out on Wednesday, building permits, housing starts, and the Export Price Index data that will come out on Thursday.

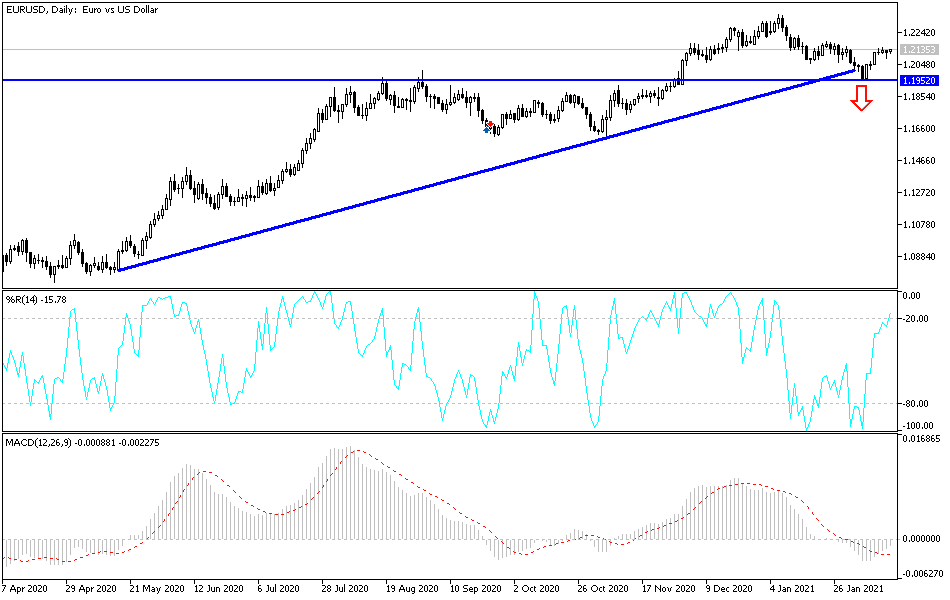

EUR/USD Technical Outlook

The four-hour chart shows that the EUR/USD price formed a bullish engulfing pattern on Friday. Today, the pair continued its upward trend and reached an intraday high of 1.2135. The pair is above the 25-day exponential moving average and the Ichimoku cloud. Also, it is slightly below the 50% Fibonacci retracement level.

Therefore, in the immediate near term, the pair may continue rising as bulls target the next resistance at 1.2150, which was the highest level last week. A move above this level will mean that bulls have prevailed. As such, they will attempt to test the next resistance at 1.2200.