Bullish Case

Buy the EUR/USD (inverted head and shoulders pattern).

Have the initial take-profit at 1.2060 (neckline).

Add a stop-loss at 1.2000.

Bearish Case

Add a sell-stop at 1.2015 (slightly below the right shoulder).

Set a take-profit at 1.1950 (Feb low).

Add a stop-loss at 1.2050.

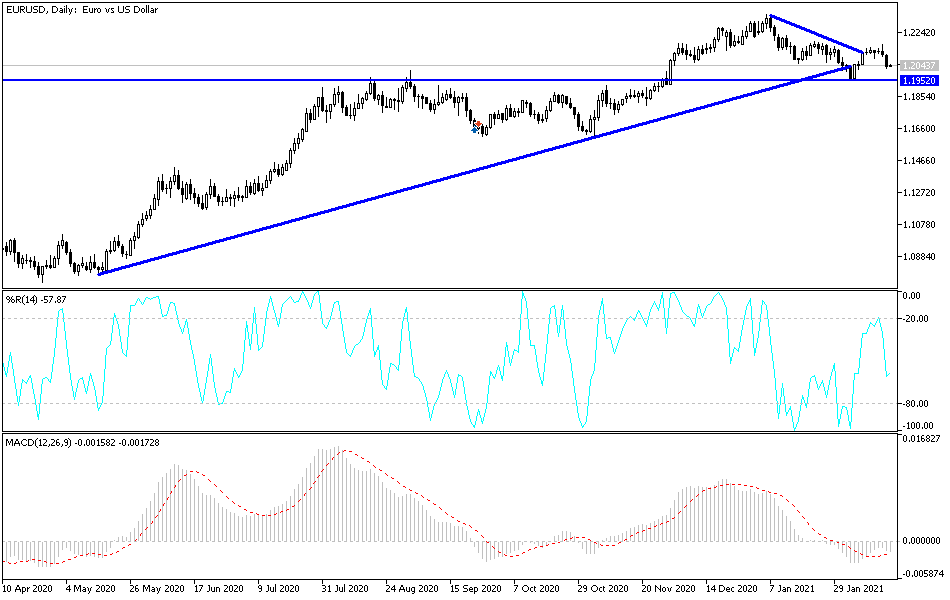

The EUR/USD price dropped in overnight trading as investors reacted to the relatively strong US retail sales numbers and the minutes of the Federal Reserve. The pair is trading at 1.2043, which is 1% below this week’s high of 1.2170.

Strong US Data

The $900 billion stimulus passed by Congress in January had a positive impact on the US economy. According to the Bureau of Labour Statistics (BLS), the country’s retail sales jumped by 1.3% in January leading to an annualised increase of 7.43%. These numbers were better than what most economists were expecting. Similarly, core retail sales rose by a monthly rate of 5.9%.

US inflation also continued to rise in January. Last week, data revealed that the Consumer Price Index (CPI) rose by a 5-month-high of 1.4% in January. Yesterday, the bureau reported that the headline Producer Price Index (PPI) and core PPI rose by 1.7% and 2.0%, respectively.

Meanwhile, the pair also reacted to the latest minutes of the Federal Open Market Committee (FOMC). The committee members said that they will leave interest rates low and continue with the asset purchases for the foreseeable future. They also warned that the pandemic continued to pose considerable risks to the American economy.

Still, with Congress talking about a bigger $1.9 trillion stimulus, there is a possibility that the bank will start tapering this year.

The EUR/USD will today react to more economic numbers from Europe and the United States. In Europe, the European Central Bank (ECB) will publish minutes of the latest meeting. In the US, the statistics office will publish the latest initial jobless claims numbers. Other important data will be the housing starts, building permits, and the Philadelphia Fed Manufacturing Index.

EUR/USD Technical Outlook

The EUR/USD price dropped to a low of 1.1950 early this month. It then bounced back to the current level of 1.2000. On the four-hour chart, the pair has formed an inverted cup and handle pattern that usually points to a bullish reversal. The price is on the right shoulder. It is also along the lower line of the Donchian channels. Therefore, the pair will likely bounce back as bulls attempt to complete this pattern. If this happens, the next key level to watch is the neckline at 1.2160.