Bullish View

Set a buy stop at 1.2180 (a few pips above last week’s high).

Add a take-profit at 1.2230 and stop-loss at 1.2130.

Bearish View

Set a sell-stop at 1.2145 (19th Feb high).

Add a take-profit at 1.2100 and stop-loss at 1.2200.

The EUR/USD is in a tight range ahead of important economic releases from the United States (US) and the European Union (EU). The pair is trading at 1.2163, which is slightly below this week’s high of 1.2180.

US GDP Data Ahead

The EUR/USD is in a holding pattern as traders wait for the second estimate of the US economic performance in the fourth quarter.

Economists polled by Bloomberg expect the data to show that the US economy expanded by 4.0% in the quarter after rising by 33.1% in the third quarter. They also expect that the GDP Price Index rose by 2.0% while GDP sales rose by about 3.0%.

The relatively strong numbers will be because of the rising private consumption and rising capital expenditure.

However, while the GDP numbers are usually watched closely, the impact on the EUR/USD will be muted. That’s because the figures will likely be similar to those released in January.

Meanwhile, investors will also react to the important durable goods orders, pending home sales, and initial jobless claims data. Indeed, these numbers will likely have more impact on the EUR/USD.

From Europe, the European Commission will publish the latest sentiment data from individuals and companies. Economists expect that the industrial and services sentiment will have improved in February as the region started to ease restrictions. The sentiment is also improving because of the ongoing vaccination drive.

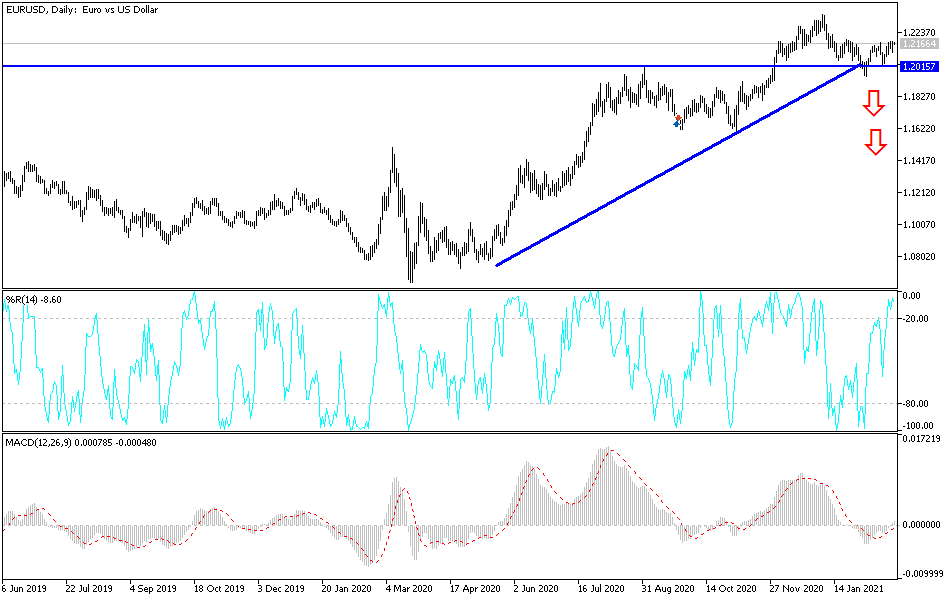

EUR/USD Technical Forecast

The EUR/USD price started rising on February 17 when it bottomed at 1.2022. This week, it rose to 1.2180, which was more than 1.3% above the lowest level on Wednesday last week.

The two-hour chart shows that the pair has found some substantial resistance near the current range. The pair seems to be forming a double-top pattern and is also slightly above the 25-period exponential moving average.

Therefore, the outlook for the pair is neutral. If it manages to move above last week’s high of 1.2180, it is a sign that bulls have prevailed. This will lead to more upside above 1.2200. On the other hand, a drop below 1.2145 will be a sign that there are still sellers in the market willing to push it lower.