As we await of the release of Eurozone inflation figures, the EUR/USD is struggling not to collapse below the 1.2000 psychological support level. The recovery of the US dollar contributed to the pair retreating to the 1.2011 support level before settling around the 1.2050 level as of this writing. In general, the euro came under pressure against the dollar, the pound and other major currencies during the latter half of January, as some Forex analysts said that the introduction of the slow vaccine in the Eurozone puts its economy at a disadvantage against those with faster rollouts.

Scientists argue that once a country attains vaccine-driven herd immunity, restrictions on movement and interactions can be lifted on a sustainable basis. Now the assumption that has been driving the markets in recent months is that 2021 will witness a "big breakthrough" for the global economy, which will lead to a decrease in the demand for the US dollar and an increase in the demand for growth-supporting assets such as stocks and the euro.

There was also supposed to be a rebound in economic activity in the Eurozone, allowing for a degree of EUR outperformance. But bottlenecks in vaccine distribution and production, and accusations of a failed purchase in the European Union, mean that the bloc is lagging behind its peers, which puts its economies at risk of fully reopening at a later time, unlike what may happen in the United Kingdom and the United States of America. Commenting on this, Société Générale's Kate Jokis says, “I still think we're in the volatile G10FX markets for a few more weeks. The clear trend is still one of the US outperforming Europe. The EUR/USD pair has been trading at 1.2050-1.22 since mid-January and there is a greater risk of a break-down from the top this week.”

The general rule is that rising stock markets denote "risky" investor sentiment, and that the flow of dollars into stocks and other financial assets is duly occurring, leading to a lower dollar. But the rise in the dollar and the rising stock market at the same time may indicate a break in the relationship, and thus it has the potential to put expectations of the dollar exchange rate in 2021 out of the norm.

The European economy shrank by 0.7% in the last three months of 2020 as businesses were subjected to a new round of lockdowns aimed at containing the resurgence of the coronavirus pandemic. The decline from the previous quarter was not as severe as experts had expected. But the official figures released yesterday cannot erase the gloomier forecast for this year. The 19 Eurozone countries are expected to lag behind China and the United States in recovering from the worst of the epidemic.

Eurostat numbers confirmed a volatile year of strange economic data, with a drop of -11.7% in the second quarter, the largest since the statistics began in 1995, followed by a 12.4% rebound in the third quarter in late summer. The winter wave of coronavirus infections has led to new restrictions on travel and business activities, although companies in some sectors such as manufacturing have been more resilient than service companies such as hotels and restaurants.

The German economy, the largest in Europe, expanded a meager 0.1% in the fourth quarter, while France saw a smaller-than-expected 1.3% decline. All in all, economists expected a fall in the Eurozone of up to 2.5%. For the year, the Eurozone contracted 6.8%. The numbers arrive amid disappointment and finger-pointing over the slow pace of vaccine launches in the European Union, while the United Kingdom, which has left the European Union, started earlier and vaccinated people at a faster pace.

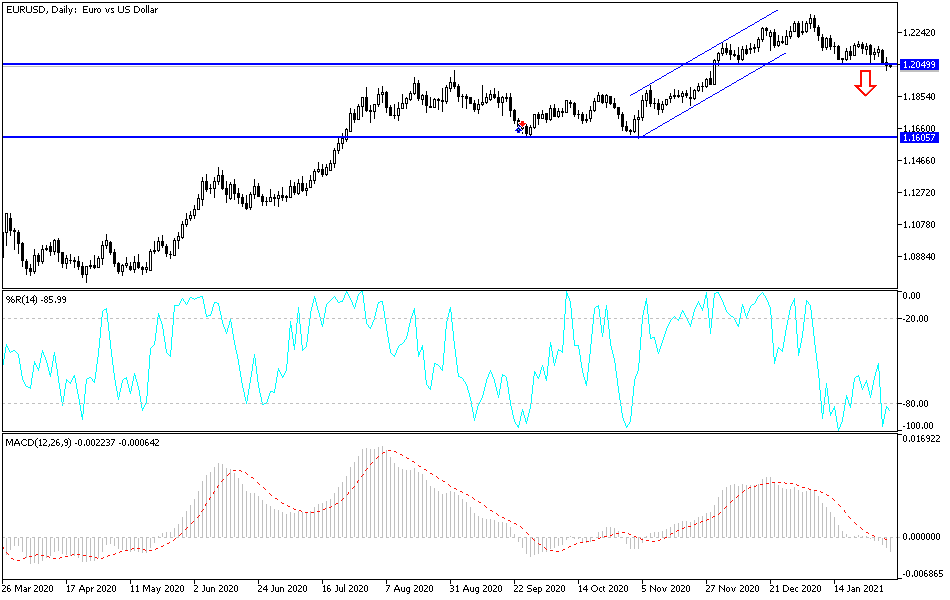

Technical analysis of the pair:

Breaching the 1.2000 psychological support level of will technically increase selling and move towards stronger descending levels, the closest of which are currently 1.1975, 1.1880 and 1.1800. This is taking into account that moving below the first support pushes the technical indicators to oversold areas. Therefore, any improvement in investor sentiment means accelerating buys to gain a bounce. On the upside, the resistance of 1.2300 will remain an important symbol for the bulls to control performance again.

Today's economic calendar:

For the euro, there will be a Service PMI reading for the Eurozone economies, followed by consumer prices and European producer prices. For the USD, there will be the change in US non-farm jobs and the ISM Services PMI reading.