The bearish path that the EUR/USD pair is traversing is getting stronger, with the pair approaching the psychological support level at 1.2000. Risk-aversion and the EU's flailing vaccine rollout increased pressure on the euro, and the positive European inflation numbers yesterday did not help.

The 1.20 level is providing massive support for the EUR, although some traders have warned of a "huge wave of capitulation" if the daily close below continues. At the same time, technical analysts point out that the 1.2014 level is the accurate historical level on the charts, as the euro will be at the bottom and prone to slipping towards 1.1750 and perhaps even lower, with any drop below 1.1695 sufficient to move towards its lowest low in 12 years.

Eurostat data showed that inflation in the Eurozone rose to 0.9% last month from -0.3% previously, and had been anticipating a significant increase to 0.6%. Core inflation, the most important measure for interest rate makers at the European Central Bank, rose from 0.2% to 1.4%, with expectations of 0.9%. Commenting on the numbers, Klaus Festissen, Chief Economist for the Eurozone at Pantheon Macro Economics, said: "This is amazing data, but we suspect that the real consensus has been prepared, to some extent, in light of the very strong advanced data." European inflation rates have always been very low for the European Central Bank, which is charged with using its monetary policies to achieve a steady inflation rate “close to 2% but less than 2%” in the medium term.

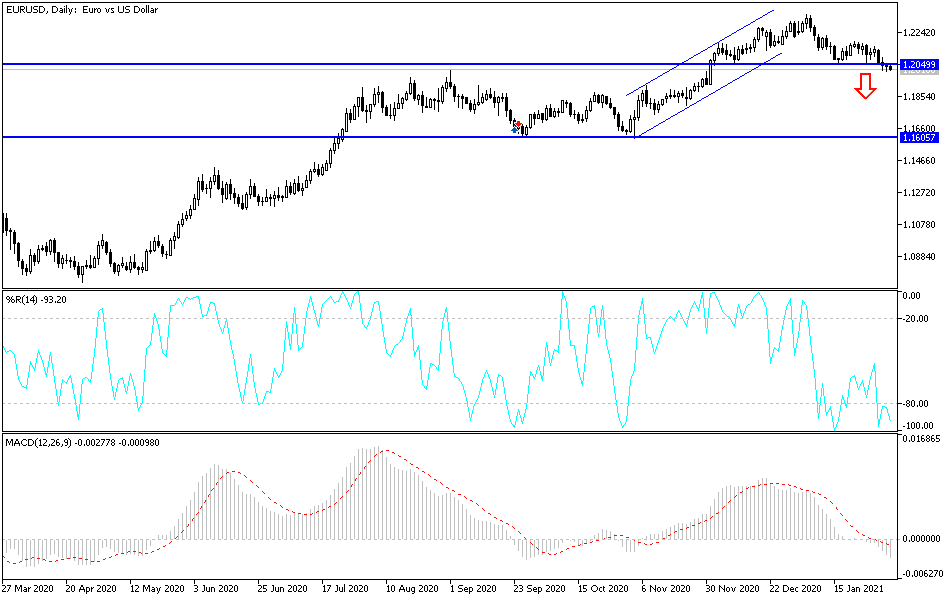

Technical analysis of the pair:

The EUR/USD pair fell recently through the 1.2065 support area and reached its lowest level at 1.2011. It seems that the pair is ready to re-test the broken support, which may hold as resistance from here. The area of interest is lined up with the 38.2% Fibonacci retracement level, which may be enough to keep gains in check and push the pair to a swing low. The bigger correction may continue until the 61.8% Fibonacci level, which is close to the psychological key level of 1.2100. Overall, the 100 SMA is still below the 200 SMA to confirm that the overall trend has turned bearish and that selling is likely to resume. The 100 SMA also approaches 50% to 61.8% Fibonacci to add to its strength as resistance.

The stochastic is already indicating overbought areas and might be due to the downside pressure. This may indicate a return to selling pressure soon, although the RSI is still heading higher to show that some upward pressure remains. The breach of psychological support 1.2000 will increase the bears' control to rush towards stronger support levels, the closest of which are 1.1975 and 1.1880. On the upside, the bulls' control will return strongly in case it stabilizes above the resistance at 1.2300 again. The slow pace of the European coronavirus vaccination rollout and risk-aversion will continue to weaken the currency pair for a while.

Today's economic calendar:

For the EUR, the European Central Bank's monthly report and retail sales figures in the Eurozone will be announced. For the USD, weekly jobless claims, non-agricultural productivity and US factory orders will be announced.