Low risk appetite has compensated the US dollar for its recent sharp losses. This perhaps explains the sell-offs of the EUR/USD, which pushed it towards the 1.2023 support level, closer to breaching the 1.2000 psychological support, which will be important for a bearish performance. The pair's gains during the trading session this week reached the resistance level at 1.2170, and it is stabilizing around 1.2045 at the time of writing. The results of strong US economic releases helped the dollar to continue gaining ground. This was evident with the announcement of the US retail sales numbers, which reached their highest since last June, confirming the importance of the US emergency stimulus plans presented by the US administration amid the suffering of the labor market in the country due to the pandemic.

After recent declines in US retail sales, the Department of Commerce released a report showing a strong rebound in retail sales of much more than expected in January. Sales rose 5.3% in January after falling 1.0% in December. Economists had expected retail sales to rise by 1.1%, compared to the 0.7% decline originally announced from the previous month.

Excluding a 3.1% increase in retail sales of cars and parts, retail sales were still up 5.9% in January after falling 1.8% in December. Economists had expected previous car sales to increase by 1.0%, compared to a 1.4% decline originally on the previous month. The closely watched core US retail sales, which excludes automobiles, gasoline, building materials and food services, rose 6.0% in January after falling 2.4% in December.

Commenting on the numbers, Michael Pearce, Chief US Economist at Capital Economics, said the sharp rise in retail sales highlights just how fast the reopening and $600 stimulus checks have turned into stronger spending.

The Biden administration says it will spend more than $1.4 billion to boost test supplies and coordination as US officials aim to get more students back into the classroom. The White House said it would spend $815 million to increase manufacturing in the United States of America for test supplies that have been in recurring shortages for several months, including materials used in labs and rapid point of care tests. Officials also announced $650 million to create regional "hubs" across the country to help coordinate testing in K-8 schools, universities, homeless shelters and other gathering places.

One of the most enduring stumbling blocks in the federal government's response to COVID-19 is the US’s failure to provide rapid and widespread testing. As a candidate, Biden has said that his administration will provide free and comprehensive testing on a national scale. He has asked Congress to provide $50 billion to test the stimulus bill in front of lawmakers.

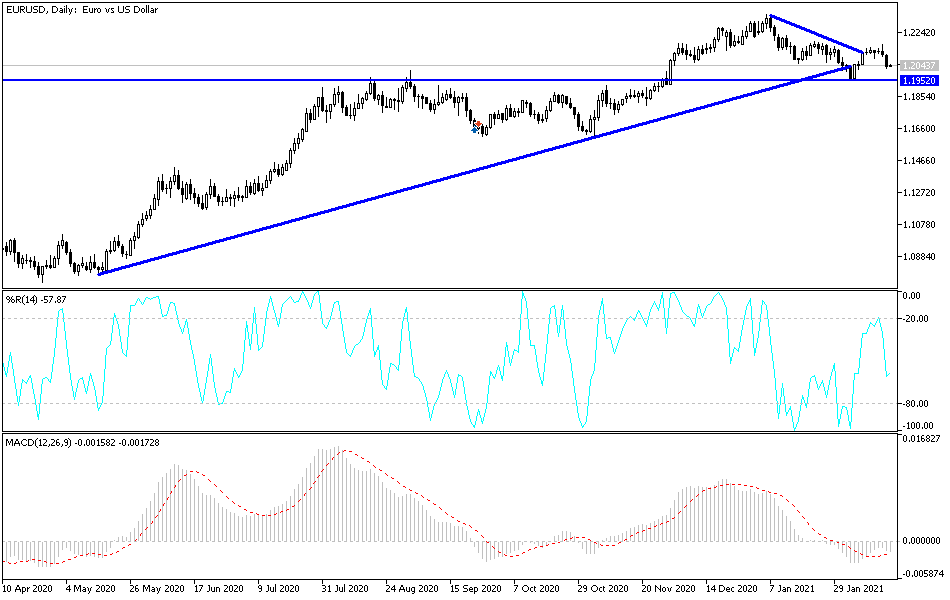

Technical analysis of the pair:

The recent decline of the EUR/USD currency pair is of interest to Forex traders. The euro's gains will likely be sold off in light of the European delay in the pace of vaccination against the coronavirus, which delays the bloc in the economic recovery path expected in 2021 compared with other global economies, especially Britain. Technically, the breach of the 1.2000 support will be important for the bears in controlling the performance in the coming days, and the major focus will be below the 1.1950 support level, from which the pair rebounded at the beginning of this month’s trading to its recent gains.

On the upside, the bulls will still aim for the resistance level of 1.2300 as their strongest opportunity to control the performance again.

Today's economic calendar:

The European Central Bank's monetary policy report will be announced, and at a later time the Eurozone consumer confidence reading. Regarding the dollar, the Philadelphia Industrial Index reading, the number of weekly jobless claims, then building permits and housing starts will be announced.