The bearish performance of the EUR/USD pushed the pair to the 1.2058 support level last week, but cut its losses and closed the week’s trading around the 1.2135 level after trying to rebound to the 1.2160 resistance. The euro has been negatively affected by the obstacles facing the European vaccination rollout, at a time when the European continent is suffering from record numbers of injuries and deaths from the epidemic. This is in addition to the weak economic expectations even with the emergence of vaccines, especially those expectations received from the largest economy in the Eurozone.

The German Finance Ministry said at the end of the week that the head of Germany's Financial Supervision Authority will leave his post with the reorganization of the agency in the wake of the accounting scandal at the payment systems provider Wirecard. After the outbreak of the scandal last year, German Finance Minister Olaf Schultz said that he wanted to renew the system of financial supervision in the country.

Tech star Wirecard once filed for protection from creditors through bankruptcy proceedings in June after admitting that 1.9 billion euros ($2.3 billion) presumably held in trust accounts in the Philippines may not have existed. German authorities have been criticized for failing to intervene quickly, despite reports of irregularities going back at least five years. Schulze called for new powers to be given to the Financial Supervision Authority, BaFin.

By the end of the week, it was announced that the US Core Personal Spending Price Index for December exceeded the expected change (monthly) of 0.1%, by 0.3%. The index (year-on-year) also beat expectations by 1.3% with a change of 1.5%. On the other hand, personal income for the month of December beat expectations (monthly) of 0.1% at 0.6%, while the personal spending rate exceeded expectations of -0.4%, recording -0.2%. The Chicago PMI for January beat expectations of a reading of 58.5, with a reading of 63.8, while the Michigan Consumer Sentiment Index fell below expectations by 79.2 with a reading of 79.

Prior to that, it was announced that the US primary GDP growth rate for the fourth quarter matches the annual estimate of 4%. The result (quarterly) missed expectations of 2.4% with a recording of 1.9%. The initial and continuing unemployment claims came out better than expected. December durable goods orders fell 0.9%, with a 0.2% reading, while non-defense capital goods orders matched expectations for a 0.6% reading.

Austria and Germany have announced that they will provide medical assistance to Portugal as the country is struggling with an increase in cases of coronavirus. In this regard, Austrian Chancellor Sebastian Curtis said that the country in the Alps would receive intensive care patients from Portugal, without specifying the number. Meanwhile, the German army intends to send medical aid and doctors to Portugal in the coming days. Defense Ministry Spokesman Christoph Choilong said the military "will provide personnel and material support", although details regarding the scope and timing are still being worked out.

Portugal has one of the worst outbreaks of coronavirus in the world compared to its population.

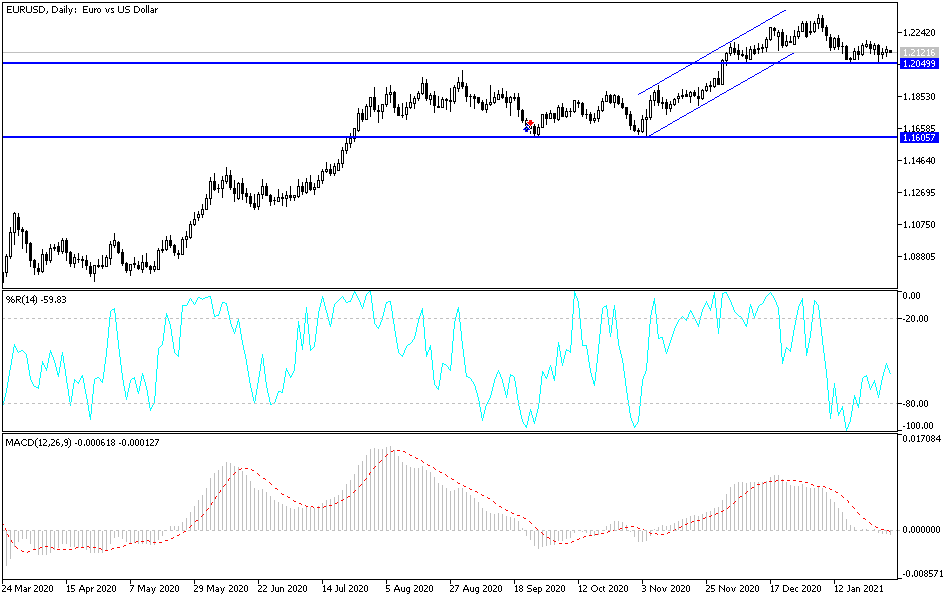

Technical analysis of the pair:

In the near term and according to the performance on the hourly chart, the EUR/USD appears to be trading within a relatively volatile wedge formation. The pair recently pulled back to avoid crossing over into overbought levels in the 14-hour RSI. It has stabilized between the 100 and 200 SMAs. Bulls will target short-term gains around 1.2152 or higher at 1.2176. On the other hand, the bears will target the gains for a decline around 1.2112 or less at 1.2085.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a rising wedge formation. This indicates a significant long-term bullish bias in market sentiment. Accordingly, the bulls will look to extend the current bullish trend by targeting profits around 1.2220 or higher at 1.2331. On the other hand, the bears will be looking for long-term gains around 1.2037 or lower at 1.1925.

Today's economic calendar data:

For the euro, there will be the announcement of German retail sales, followed by the Industrial PMI reading for the Eurozone economies. For the US dollar, the ISM Manufacturing PMI and Construction Spending Index will be announced.