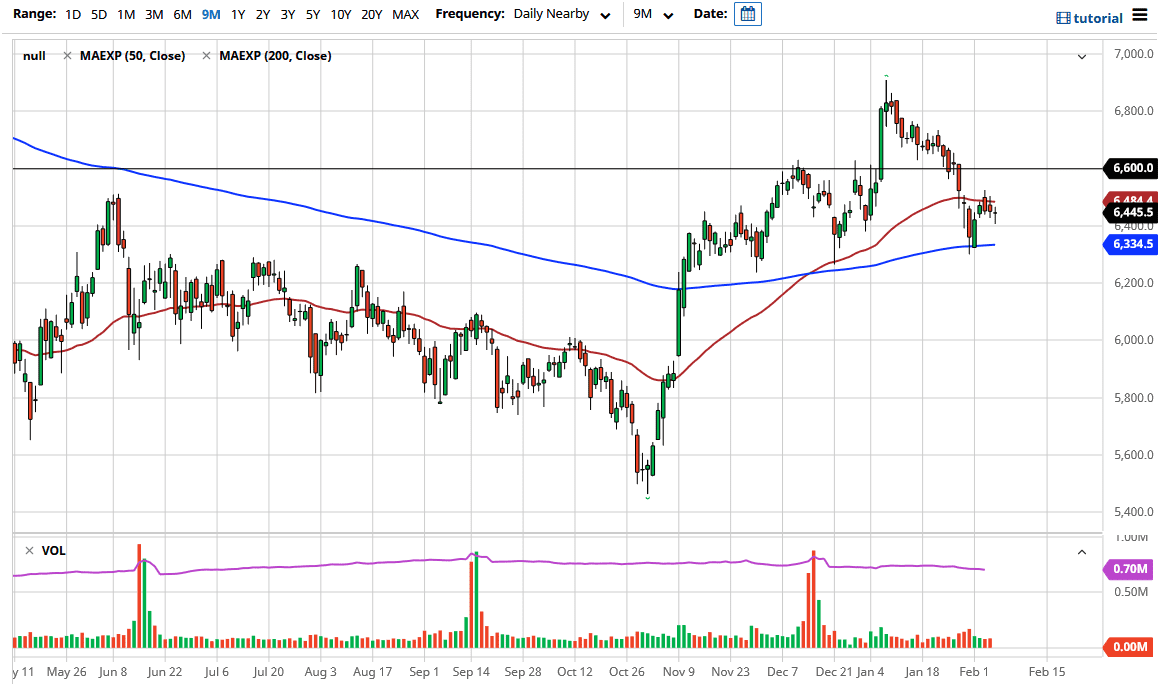

The FTSE 100 fluctuated during the course of the trading session, as we stabilized at the 6400 level. The market looks as if it is going to try to recover as I had suggested previously, so if we can break above the 50-day EMA it could open up a move towards the 6600 level. A move above there then really gets things going higher, perhaps reaching towards the 6900 level, possibly even attacking the 7000 level.

The FTSE 100 will be paying close attention to the UK economy, which has been locked down for some time. A lot of people are looking at the lockdowns as coming to an end, and that could help bolster the UK economy. Furthermore, the coronavirus vaccine has been distributed much more openly and aggressively in the United Kingdom that many other places on the planet. That could, in theory, open up the possibility of a big move in the UK economy. After all, markets tend to overcorrect, and the whole Brexit fiasco which was supposed to be the end of the United Kingdom is turning out to be a less than toxic situation. In other words, drama took over the market yet again. Now, the question is: how long will take the United Kingdom to turn things around?

The shape of the candlestick is a hammer, which suggests that there are buyers underneath. Even if we did break down below the 6400 level, the 200-day EMA is closer to the 6334 level, and an area that has been supportive recently. We are trying to fight to the upside. If we were to break down below the 200-day EMA, then it could open up the possibility of a move down to the 6000 handle where there is a gap just below. That could be the target on a significant breakdown. However, right now the only thing that I see possibly causing problems for the FTSE 100 is the fact that the British pound is trying to break out to the upside, and that would make exports coming out of the UK much more expensive internationally. I suspect that we still have plenty of support underneath, and it makes sense that we will continue this choppy upward grind.