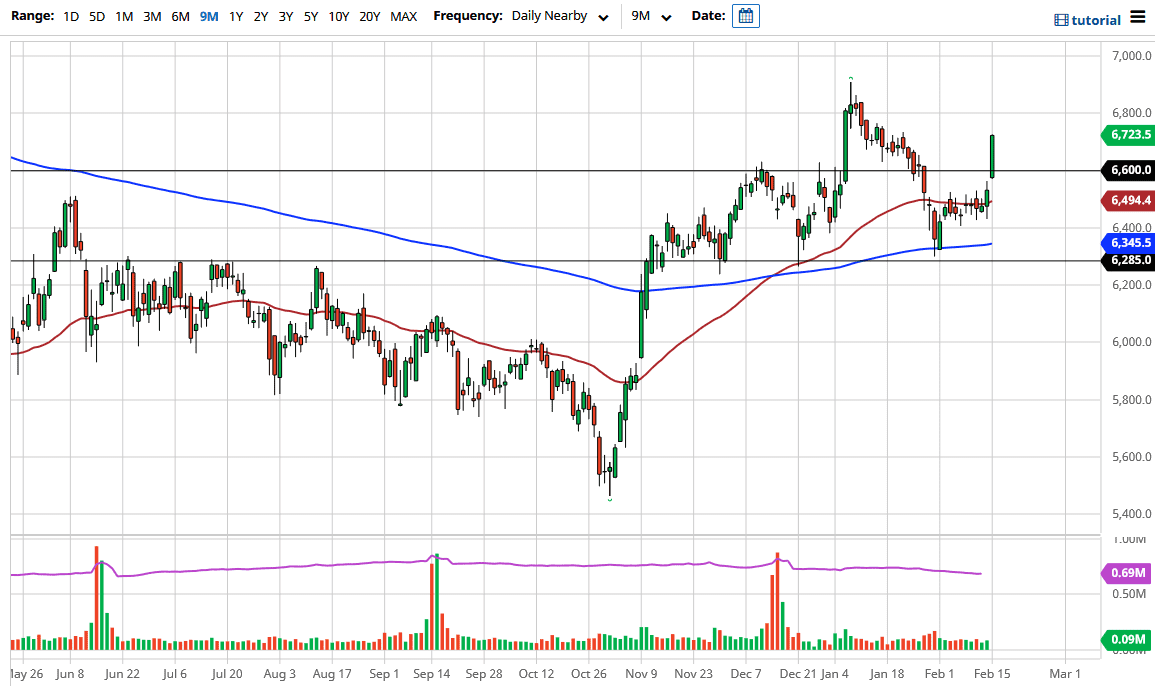

The FTSE 100 has taken off during the open on Monday, gapping higher and then slicing through the 6600 level like it was not even there. The market gained a triple digit level due to gains from commodities, as well as the boost from the coronavirus vaccine hopes. With commodity and oil names at the forefront of the surge, this is a rally that shows no sign of slowing down in the short term. The global “re-opening trade” looks very unlikely to slow down, and the FTSE 100 has been boosted as the UK has succeeded in giving 15 million people a first dose of the vaccine.

While the biggest winners were in the oil sector, it was seen across-the-board, as it appears that people are banking on not only the global markets and economies opening up, but the United Kingdom perhaps leading the way as they have been much more aggressive with their vaccination policy. Furthermore, Brexit is in the rearview mirror now, so even though there is still quite a few issues to work through, the reality is that the bulk of the problems are now off the table. With that being the case, the market is likely to go looking towards the highs again, and any time we see a short-term pullback, it should be a nice buying opportunity.

I believe that the 6600 level is probably going to offer a certain amount of psychological as well as structural support, but even if we do break down below there, there is a small gap underneath that should offer support as well. In other words, I think that all we are seeing is an opportunity to pick up value every time it drops, but if we did break out to a fresh, new high, then we are going to go looking towards the 7000 level, which is the next major psychological barrier. The one thing that could drag the FTSE a bit would be the fact that the British pound suddenly is taking off, and in theory that makes exports expensive, but I do not believe that we are anywhere near a level that would concern most traders. Because of this, I think if you are patient enough, you should be able to get an opportunity; but the fact that we closed at the top of the candlestick suggests that we may have further to go immediately.