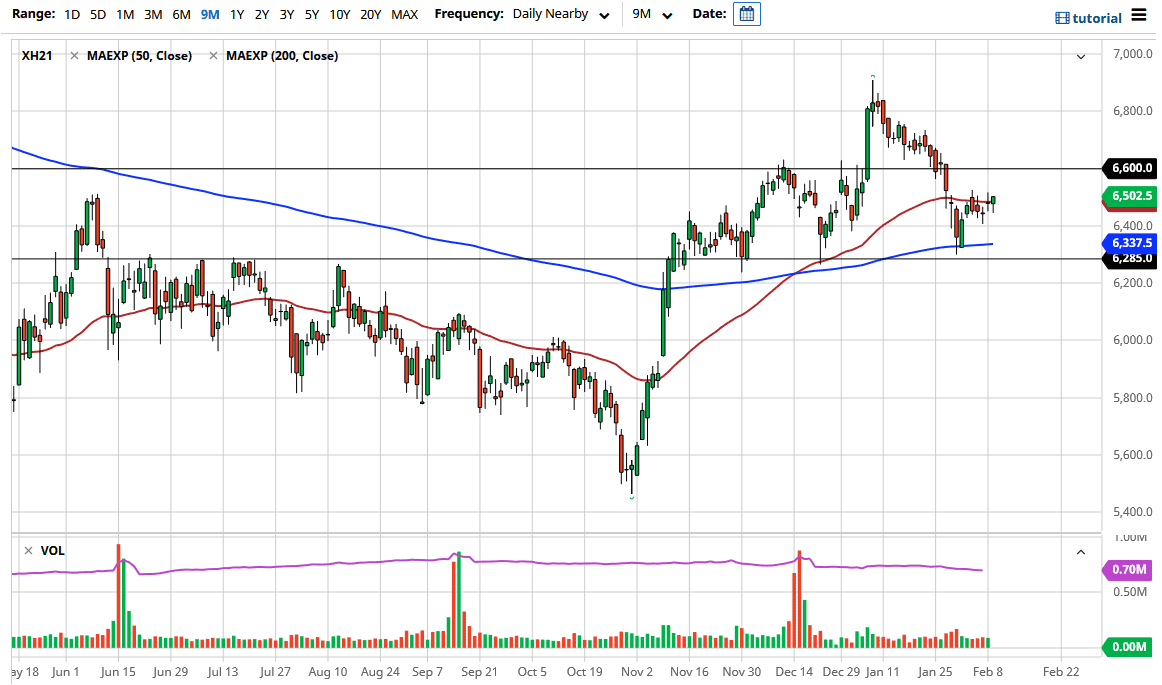

The FTSE 100 fluctuated during the trading session on Tuesday as we continue to see plenty of choppiness right around the 50-day EMA. The 50-day EMA is a major technical indicator, and an area where we have gone back and forth for the last week or so. This is a market that continues to show a lot of choppy volatility due to the fact that we have a lot of questions when it comes to the United Kingdom.

The UK has locked its economy down rather stringently to fight the coronavirus, and the vaccination has been distributed quite widely. Because of this, the market is likely to see a lot of back and forth, but I do believe that the buyers will continue to go into the market and push towards the 6600 level above. That is an area where we have seen a significant break down, so I think that a lot of people will be looking at it as a potential barrier that is going to be hard to get above.

If we break above that level, then it is likely that the market will go looking towards the 6700 level, and then possibly the 6800 level. To the downside, if we do break down from here, it is likely that the 200-day EMA gets tested for support near the 6337 level. I think there is support all the way down to the 6285 level. This is a market that is trying to form a nice base, and if the UK economy continues to look likely to recover from the coronavirus quicker than some of the other economies around the world, then the FTSE 100 should continue to see a push higher. The one thing that could be working against the value of the FTSE 100 could be the fact that the British pound has started to appreciate, and therefore people may begin to worry about the value of the currency in reference to exports. I do not think that is an issue at the moment, so it is likely that we will eventually take out the 6600 level above. It might take some time to get above there, but clearly it looks like the world is starting to look at the United Kingdom through more positive light.