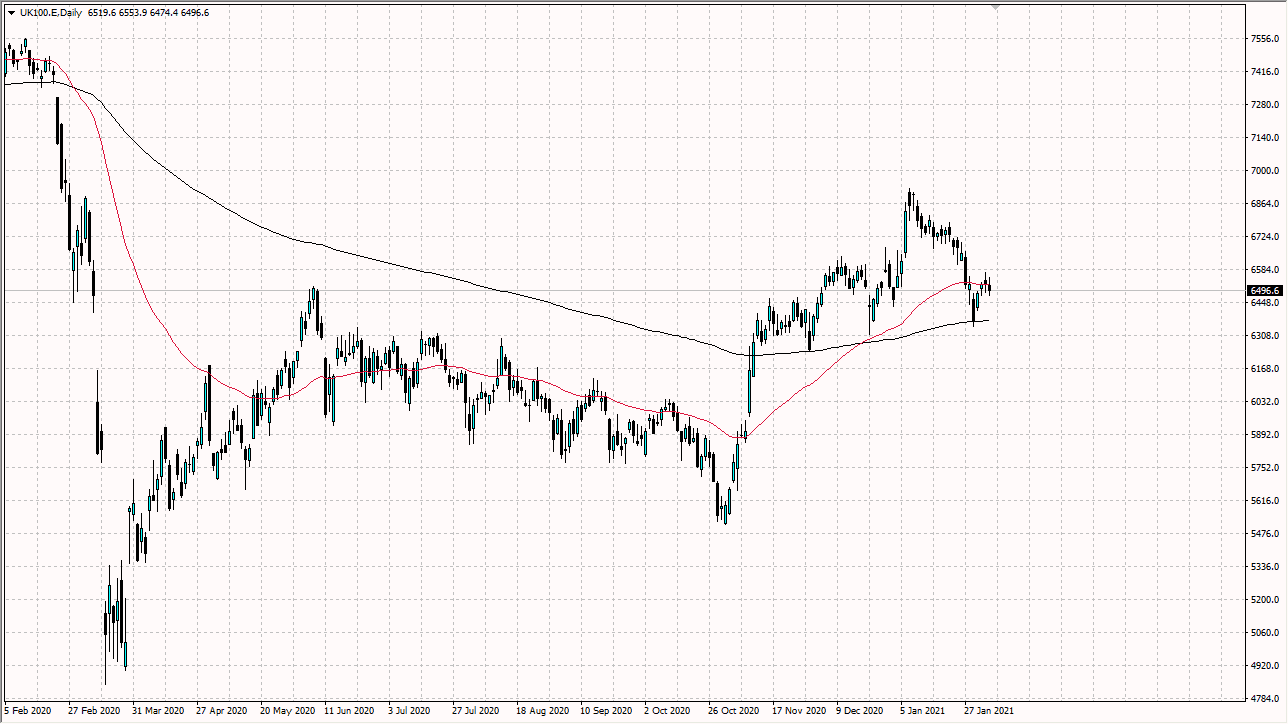

The FTSE 100 initially rallied a bit during the trading session on Thursday but gave back the gains as the shooting star from the previous session continues to reassert its resistance. The 6580 level seems to be resistance, and therefore it is very likely that we would pull back from there and go looking towards the 200 day EMA underneath.

Part of the problem with the FTSE 100 during the last 24 hours probably would be rooted in the British pound strengthening during the trading session after the Bank of England suggest that negative interest rates were almost impossible. With that being the case, the idea is that British exports will be more expensive, thereby it weighs upon the possibility of profitability. The candlestick has shown itself to be hesitant, and perhaps suggesting that the market could go looking towards the 200 day EMA underneath. The 200 day EMA currently sits near the 6325 level, and it does not take too much in the way of imagination to see how a trendline comes into play in that general vicinity. Ultimately, if we break down below that trendline then we could see the FTSE 100 drop pretty significantly, maybe down to the gap which is sitting at roughly 5900.

On the other hand, if we break above the 6585 level, then it would be the market slicing through a couple of resistive candlesticks and perhaps reaching towards the highs yet again. With everything being equal, the question now of course is whether or not the FTSE 100 can continue to climb longer-term due to the fact that although the economy is supposedly going to grow 5% in 2021, there are still a lot of concerns about lockdowns and the like. It is going to be very volatile in the FTSE 100 this year, mainly due to the fact that we are focusing on both the coronavirus in the British pound at the same time.

I suspect in the short term we are probably looking at a lot of volatility more than anything else, and I would expect choppy behavior. If we can hold this trend line underneath, that is still the making of a potential uptrend, but the volatility exploding the way it has over the last several months, you can certainly see how difficult it is going to be.