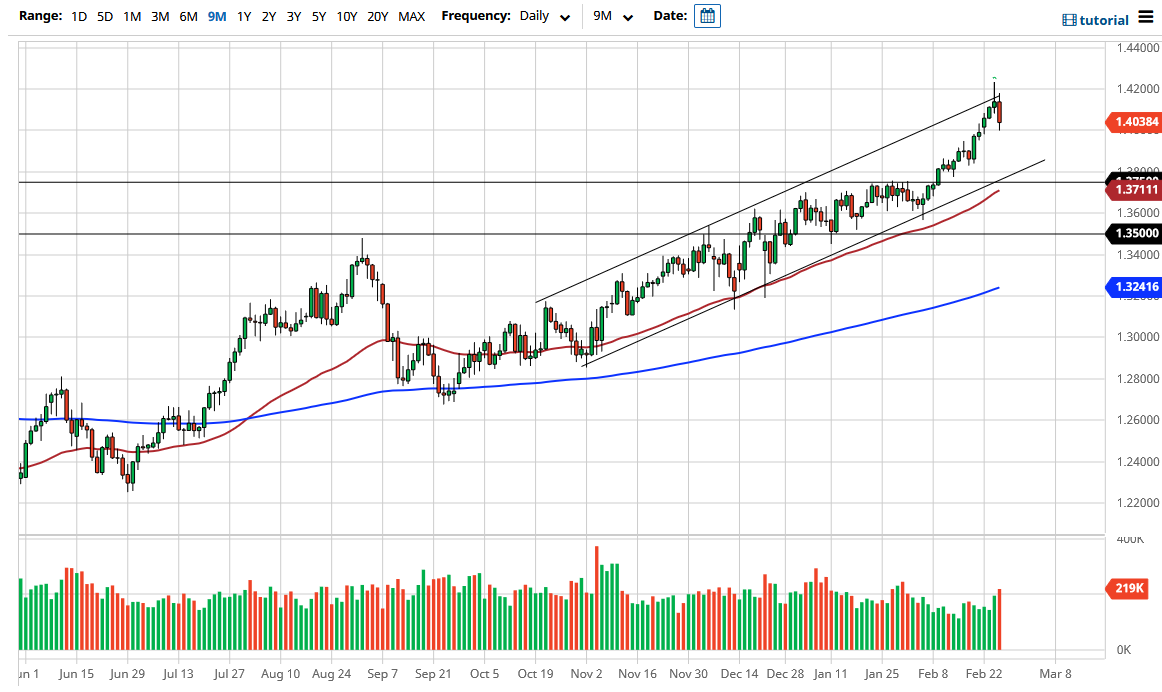

The British pound has pulled back significantly during the trading session on Thursday as the shooting star from the previous session suggested it could. We were at the top of the major up trending channel that I have marked on the chart, so it is not a huge surprise that we pullback. Furthermore, the 1.42 level above was an area where we had a lot of resistance on the weekly chart, so once we formed a shooting star, it did suggest that perhaps we were overdone.

The market fell down towards the 1.40 level during the day, which of course is a large, round, psychologically significant figure, and therefore it is not a huge surprise that we have seen some type of an attempt to keep it afloat here. Whether or not 1.40 holds or not it is something worth paying attention to, but at this point even if we were to break down below there, it is likely that the market could go looking towards the uptrend line underneath, which is just above the 1.38 handle.

When you look at the British pound, the reality is that the currency is still relatively cheap from a longer-term standpoint, so I would not be surprised at all to see it continue to go much higher, perhaps reaching towards the 1.50 level, and quite frankly we needed some type of selloff in order to have people jumping into the market to take a bit of value away, and perhaps more importantly, take profits.

Having said that, I think that we need to grind sideways more than anything else, in order to build up the necessary momentum to finally break above the 1.42 handle. Breaking above that level could be what is needed for continuation. Nonetheless, we have seen far too much in the way of momentum to continue this type of move, so I think any pullback at this point in time would be healthy. Even if we do continue to drop and reach down towards the uptrend line, I think another thing that could come into play is the 50 day EMA, which is currently trying to cross above the 1.3750 level. That is an area where we had seen a lot of previous resistance, and now should be massive support as it was the scene of the major breakout a couple of weeks ago.