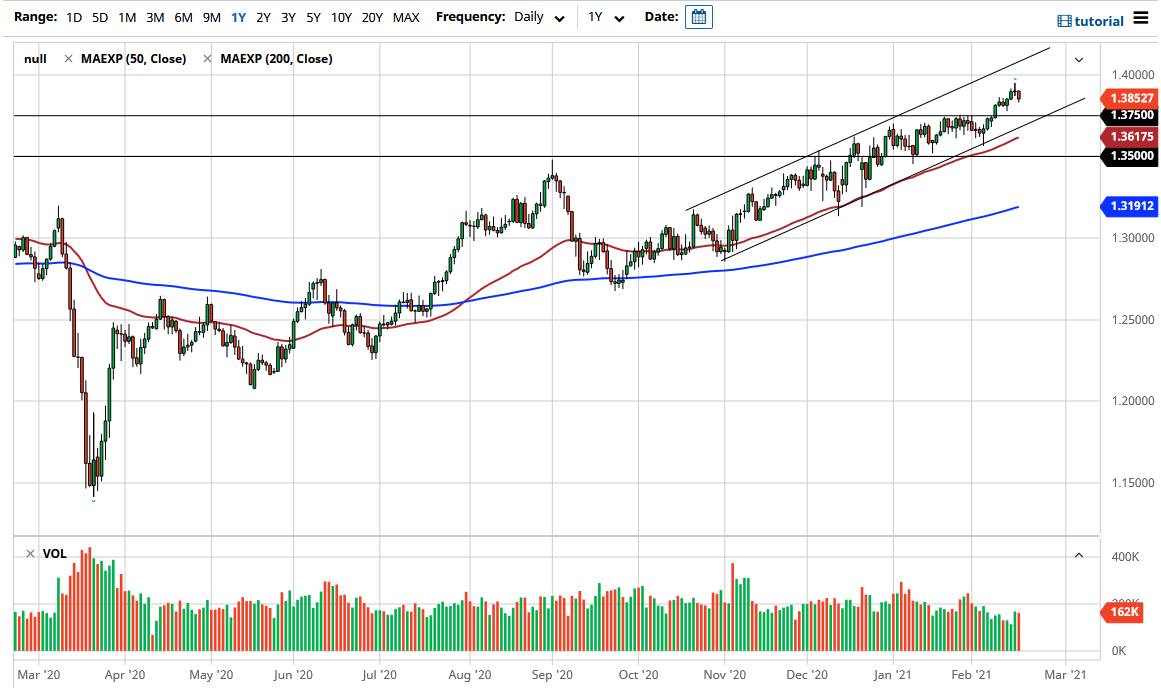

The British pound fell a bit during the trading session on Wednesday as we pulled back below the bottom of the shooting star from the previous session. In and of itself, this could be a theoretical selling signal, but I do see that there is so much in the way of support underneath near the 1.3750 level. That is an area where they step in to pick up the British pound based upon the “market memory” that we should have in that general vicinity. After all, it took quite a bit of effort to break out above there, so I think that a pullback is healthy because it allows the market to continue going higher.

The uptrend line underneath there will offer a bit of support as well. However, I think this market is simply pulling back after a nice move higher. Longer term, I believe that the British pound probably will go looking towards the 1.40 level, which will attract a significant amount of attention from the headline standpoint. Beyond that, I also see the 1.42 level as an area where people may start to take profits based upon the resistance that I see on the weekly chart. I do think that is the longer-term target, but that does not mean that we will get there overnight.

Underneath the 1.3750 level, I see a significant amount of support not only due to the uptrend line and the 50-day EMA, but also the massive amount of noise that sits just below there. With that in mind, I think that it is only a matter of time before buyers will jump in and try to pick up the British pound “on the cheap.” Furthermore, we have the US stimulus package coming that could drive down the value of the US dollar, but we have a little bit of an issue as of late: yields in the 10-year note rising. If that continues to be an issue, that will drive the US dollar higher, because it is a much more attractive asset suddenly. That is not my best case at the moment, but it is something to pay attention to for the longer-term trade, as it could cause some headaches for traders in what is certainly going to be very choppy trading regardless.