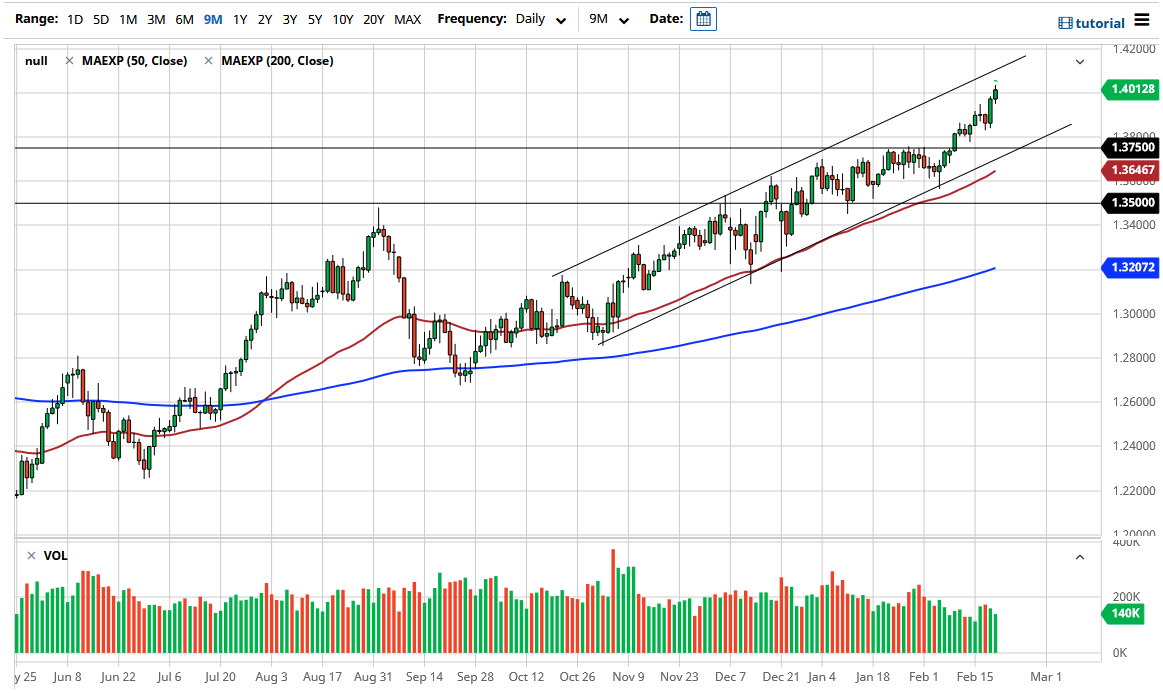

The British pound rallied rather significantly during the trading session on Friday to break above the 1.40 level as gilts started to offer much more in the way of yields, making the British pound much more attractive. Furthermore, the US dollar has been on its back foot for a while, and therefore this is a simple continuation of the overall trend to the upside that this market has been in for several months. In fact, you can see that I have a channel drawn on the chart that the market seems to be respecting, so the upside is probably limited in the short term, and a pullback could very well be coming soon.

What I do find interesting is that we did not seem to be able to stay above the 1.40 level handily. What I mean by this is that we did pull back to find that level again, as we started to close for the weekend. The market has been a little relentless to the upside, so maybe a pullback is coming. If we get one, then I think it is only a matter of time before you can find some type of value based upon a daily candlestick close. I would be very interested in the 1.3750 level for support, as we had broken out from that level previously.

On the other hand, if we were to break above the top of the candlestick for the session on Friday, that could have the market looking towards the 1.41 level where we could hit the top of the channel. Nonetheless, I think a pullback makes sense, so I would anticipate that value hunters would be looking at this market as an opportunity to take advantage of the longer-term trend that should continue. This would be due to the UK not only offering bigger yields, but the fact that we have seen 14 million inoculations in that country, which is far ahead of most of its peers. Furthermore, after that, we have to think about the fact that the economy is opening up from a very low level in the UK, meaning that it is going to have a major bounce in activity. I have no interest in shorting this market, and I am more than willing to pick up value as it occurs.