Bullish Signal

Set a buy limit trade at 1.4150.

Add a take-profit at 1.4250 and stop-loss at 1.4100.

Timeline: 1-2 days.

Bearish Signal

Set a sell-stop at 1.4130 and a take profit at 1.4050.

Add a stop loss at 1.4200.

The GBP/USD price continued to rally during the American and Asian sessions as traders reflected on the latest UK jobs and a testimony by Jerome Powell. The pair reached a high of 1.4246, which was the highest level since April last year.

Sterling Rally Continues

The British pound rallied after the relatively upbeat UK jobs numbers that were published yesterday. The report by the Office of National Statistics (ONS) revealed that the country’s unemployment rate rose slightly from 5.0% to 5.1% in December.

In the same period, wages with bonuses increased by 4.7% while those without bonuses increased by 4.1%. In January, the number of people filing for claims dropped by 20,000 even as the country went through another lockdown. These numbers provide further evidence that the Bank of England (BOE) will not implement negative rates.

The GBP/USD price also rallied during and after the first testimony by Jerome Powell, the Fed chair. He said that while the US economy was doing well, more support will be necessary. He said that the ongoing recovery remained uneven and far from complete. As a result, he expects the bank to maintain its easy money policies in the near term.

Looking ahead, there is no scheduled economic release from the UK today. Therefore, the GBP/USD will react mildly to Powell’s testimony in another congressional committee. Also, it will react to the new home sales numbers from the United States. Economists polled by Reuters expect the data to show that the sales increased from 1.6% in December to 2.1% in January.

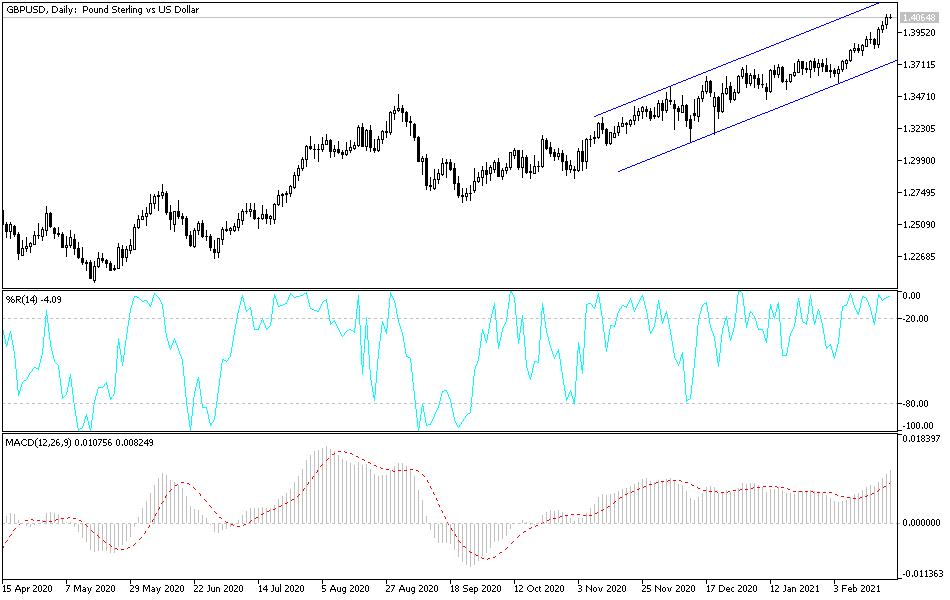

GBP/USD Technical Forecast

The GBP/USD soared to a multi-year high of 1.4246. On the four-hour chart, the pair moved above the ascending channel shown in black. The price uptrend is also being supported by the 25-exponential moving average and the Ichimoku cloud. Therefore, in the near term, the pair will likely remain in an uptrend as bulls attempt to move to 1.4383, where it formed a double-top between January and April 2018 on the weekly chart. This price is just 1.40% above the current price.