Bullish case

Buy the GBP/USD and add a take-profit at 1.3950 (upper side of the channel).

Set a stop loss at 1.3750 (previous high).

Bearish case

Set a sell-stop order at 1.3750 and a take-profit at 1.3650 (close to the lower side of the channel).

Add a stop loss at 1.3950.

The GBP/USD price is rising for the sixth consecutive day ahead of the UK GDP and industrial production numbers set for Friday. The pair is trading at 1.3848, the highest it has been since April 2018.

Weak US Inflation

The GBP/USD rally continued after the US released a relatively weak Consumer Price Index (CPI) yesterday. According to the Statistics Bureau, the headline CPI rose by 1.4% in January, lower than the median estimate of 1.5%. The core CPI that excludes the volatile food and energy products also rose by 1.4% in January, lower than the median estimate of 1.5%.

These numbers came a few days after the US published relatively weak jobs numbers because of the ongoing lockdowns. The economy added about 40,000 jobs while the unemployment rate dropped to 6.3%.

Therefore, Congress is fast-tracking the stimulus proposal by Joe Biden. The administration has put in place a $1.9 trillion stimulus package that it hopes will help supercharge the recovery. Later today, the pair will react to the new US jobless claims numbers.

Meanwhile, focus is now shifting to the upcoming UK GDP numbers that will come out tomorrow morning. The median estimate by economists is that the country’s economy expanded by 0.5% on a QoQ basis leading to an annual decline of 8.1%. The first estimate revealed that the economy contracted by 8.6%.

The GBP/USD will also react to the UK manufacturing and industrial production numbers, construction output, and trade balance. Strong numbers will provide more confidence that the Bank of England (BOE) will not implement negative rates in the near term.

GBP/USD Technical Outlook

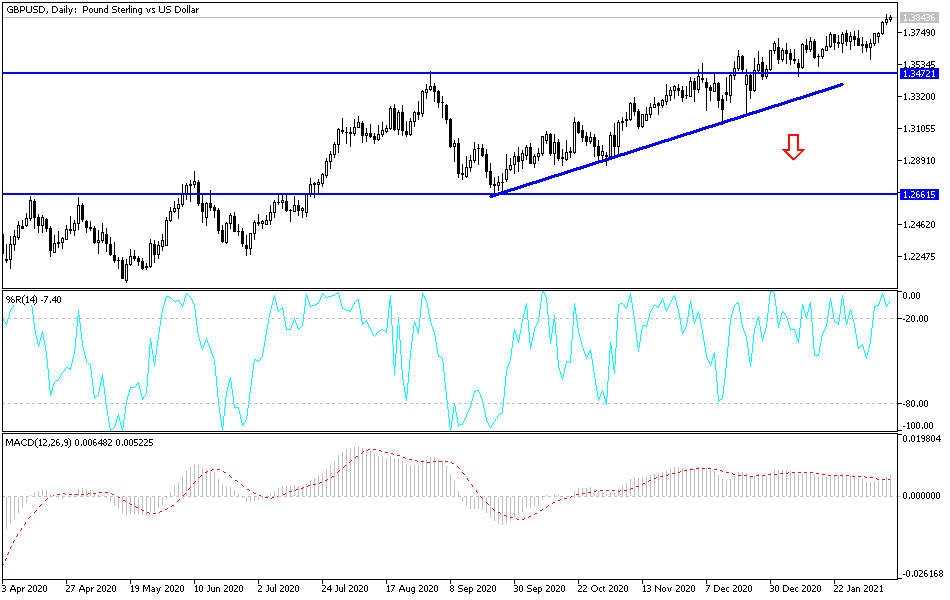

The daily chart shows that the GBP/USD price has been on a strong upward trend lately. It has moved above the 25-day and 50-day weighted moving average. Also, the price is between the ascending channel while the fast and slow lines of the MACD are also rising. Therefore, the pair may continue rising as bulls eye the upper side of the channel at 1.3950.