Bearish Case

Sell the GBP/USD based on the H&S pattern.

Have a take-profit at 1.3800 (psychological level).

Add a stop-loss at 1.3900.

Bullish Case

Set a buy stop trade at 1.3900.

Add a take profit at the YTD high of 1.3953.

Set a stop-loss at 1.3830.

The GBP/USD price retreated even after the relatively better inflation data from the United Kingdom. The pair fell to 1.3830, the lowest level since February 12.

UK Negative Rates Ruled Out?

The GBP/USD has rallied recently after the Bank of England (BOE) hinted that it will not push interest rates to the negative zone. The Consumer Price Index (CPI) data released yesterday and the ongoing process of vaccinations mean the bank will indeed not move to negative rates.

According to the Office of National Statistics (ONS), consumer prices rose by 0.7% in January, a small increase from the previous month's 0.6%. In the same period, the core CPI rose by 1.4% while PPI input rose by 1.3%. While these numbers are below the BoE target of 2.0%, they are heading in the right direction.

The GBP/USD price pulled-back mostly because of the strong dollar. The currency rose after the US statistics agency released strong retail sales numbers, helped by the $900 billion stimulus package. The headline retail sales rose by 7.4% while core sales increased by 5.9%. Similarly, the Producer Price Index rose by 1.7%, meaning that inflation could rise to 2.0% later this year. The upcoming $1.9 trillion package will accelerate this. As a result, the Fed could start tightening earlier than expected.

Looking ahead, the pair will react to the UK retail sales numbers that will come out tomorrow. Economists expect these numbers to be a bit weak because of the nationwide lockdown imposed by the government. The pair will also react to the US housing starts, building permits, and initial jobless claims data.

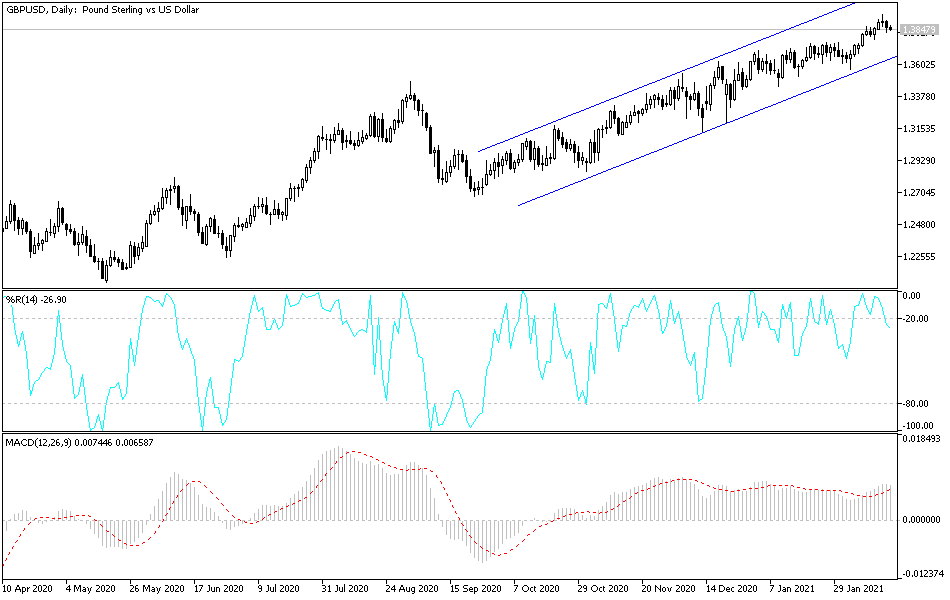

GBP/USD Technical Outlook

The GBP/USD pair rose to a multi-year high of 1.3950 this week. It then pulledback and reached a low of 1.3830 on Tuesday. The three-hour chart shows that the pair is forming a head and shoulders pattern, which is usually a sign of reversal. The pair has also moved below the Ichimoku cloud and formed a small bearish flag pattern.

Therefore, the pair may resume the downward trend as bears target the next support at 1.3800. However, this prediction will be invalidated if the pair manages to move above the 2018 high of 1.3950.