Bullish Case

Buy the GBP/USD so long as it is above the middle Bollinger Band on the 2H.

Add a take-profit at 1.4150 and stop-loss at 1.4100.

Timeline: 1-2 days.

Bearish Case

Set a sell-stop at 1.4040 (slightly below the middle Bollinger Band).

Add a stop-loss at 1.4000 (lower Band) and a take-profit at 1.4100.

The GBP/USD is rising for the fourth consecutive day ahead of the UK employment, US consumer confidence data, and testimony by Jerome Powell. The pair rose to a high of 1.4070, which is 23% above its lowest level in 2020.

UK Employment Numbers Ahead

The Office of National Statistics (ONS) will publish the latest employment numbers at 07:00 GMT. Economists expect that the UK’s unemployment rate rose from 5.0% in November to 5.1%. They also expect that the average wages with bonuses increased from 3.6% to 4.1% while those without bonuses rose from 3.6% to 4.0%.

Also, analysts expect the number of claimant count increased from 7,000 in January to 35,000 in January. Unlike in the United States, the UK employment numbers tend to have a one-month lag. Still, economists expect the overall unemployment rate to rise in the next few months as the furlough program ends.

The GBP/USD is also rising because of the ongoing vaccination program. The government has already vaccinated more than 15 million people and there is a possibility that the entire population will be covered in the next few months. In a statement yesterday, Boris Johnson talked about his plan to reopen the economy in the next few months.

The GBP/USD rally is also because of the weak US dollar as investors place their bets that inflation will push interest rates earlier than expected. The latest Consumer Price Index (CPI) data rose by 1.4% and there is a probability that it will reach 2.0% later this year because of the robust stimulus by the Fed and Congress.

Later today, the pair will react to the latest US consumer confidence data by the Conference Board and testimony by Jerome Powell. In this testimony, he will talk about the bank’s future plans as inflation rises.

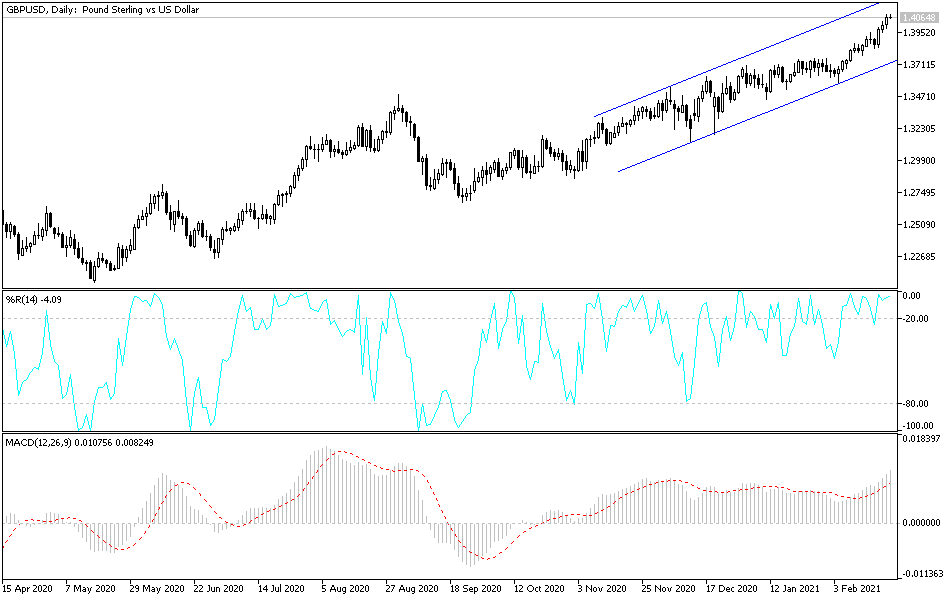

GBP/USD Technical Analysis

The two-hour chart shows that the GBP/USD pair has been in a strong upward rally. It reached a high of 1.4087 in the overnight session. Also, it is slightly below the upper side of the ascending red channel. The price is also slightly below the upper Bollinger Band and the important psychological level of 1.4100. Therefore, the pair may continue rising as bulls attempt to move above this psychological level.