Bearish Case

Sell the GBP/USD at 1.4020 and set a take-profit at 1.3987.

Add a stop loss at 1.4055, which is slightly above the rising trendline.

Bullish Case

Set a buy stop at 1.4055 hoping that the uptrend will continue.

Add a take-profit at 1.4100 and a stop loss at 1.4000.

The GBP/USD pulled back on Monday morning as traders digested the latest flash Purchasing Managers Index (PMI) and the upcoming stimulus in the US. It is trading at 1.4018, which is slightly below last week’s high of 1.4050.

UK Recovering Economy

The UK economy is in a recovery path, as evidenced by the Flash Manufacturing and Serivce PMI data published on Friday. According to Markit, the Manufacturing PMI rose from 54.1 to 54.9 while the Service PMI rose from 39.5 to 49.7. As a result, the Composite PMI increased from 41.2 to 49 amid the ongoing lockdowns.

These numbers came at a time when the trend of new infections is falling. The latest figures showed that the UK had just 10,000 new infections on Friday. That was below the seven-week average of about 16,000.

The country has also boosted its vaccination roll-out. According to the government, more than 15 million people have already received the vaccination. The government expects all adults to receive the vaccination by July 31st.

Later this week, the GBP/USD will react to the latest employment numbers that will come out tomorrow. Economists polled by Reuters expect the data to show that the UK’s unemployment rate rose from 5.0% to 5.1% in December. They also expect the wages plus bonus to increase to 4.2%. Without bonuses, they expect the wages to have increased by 4.0%.

The pair will also react to the ongoing progress on US stimulus. Later this week, Congress will likely vote to pass the $1.9 trillion stimulus proposal. It will also react to the latest US new home sales numbers and GDP data.

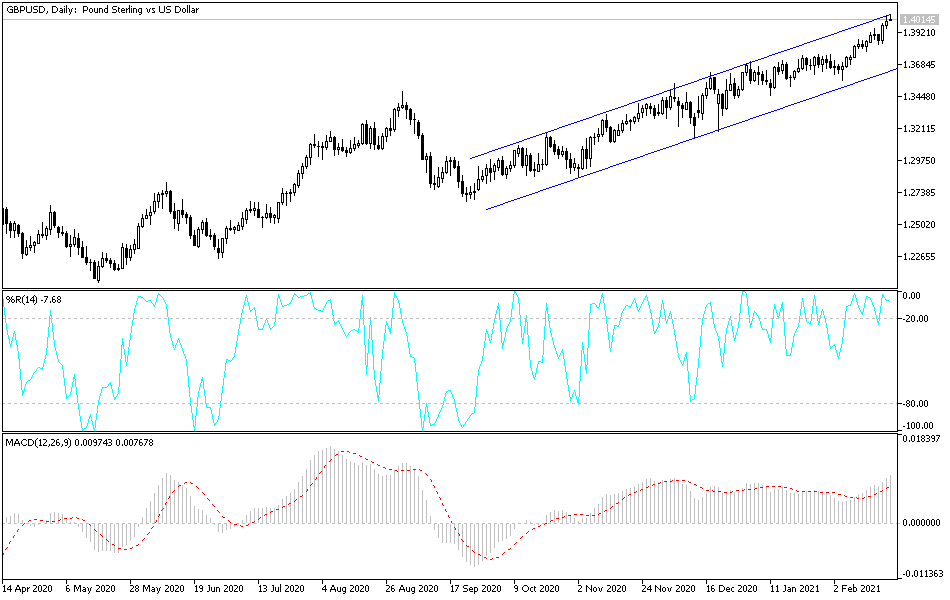

GBP/USD Technical Outlook

The GBP/USD declined to a low of 1.4018 today. This price is slightly below last Friday’s high of 1.4050, which was also the highest level since March 2018. On the four-hour chart, the price has moved slightly below the upper ascending trendline that is shown in red. This line connects the highest levels in February. It is also along the 15-day and 25-day weighted moving averages.

Therefore, while the upward trend remains, the pair may go through a pullback in the short term. If this happens, bears will likely move below 1.4000.