Bullish case

Buy the GBP/USD if it moves above 1.3700.

Set a take-profit at 1.3753 and a stop-loss at 1.3627.

Bearish case

Set a sell stop at 1.3653 (yesterday’s low).

Add a take-profit at 1.3600 and a stop-loss at 1.3700.

The GBP/USD is holding steady after the relatively mixed economic data from the UK that was released yesterday. The sterling is trading at 1.3693, which is above yesterday’s low of 1.3655.

Mixed UK Data

Yesterday, economic data by Markit showed that the manufacturing sector in the UK was relatively strong in January even as the country battled the new strain of the virus. The Manufacturing PMI increased from 52.9 in December to 54.1 in January. This figure was better than the median estimate of 52.9.

However, a closer look at the report showed that manufacturers complained about long supply delays due to COVID restrictions and disruptions by Brexit. The Service PMI numbers will come out tomorrow. Economists expect that the Service PMI dropped to 38.8 in January because of the lockdowns. This number is usually important because the services sector is the biggest employer in the UK.

The GBP/USD also reacted to the mortgage lending and approvals numbers. In total, mortgage approvals dropped from 105.32K in November to 103.38K in January. As a result, the amount of money extended also fell from 5.73 billion pounds to 5.59 billion pounds. Today, Nationwide will publish its House Price Index data.

The GBP/USD is steady ahead of the important Bank of England (BOE) interest rate decision that will come out on Thursday. In general, economists expect that the central bank will leave interest rates unchanged at 0.10%. Also, they see it leaving the quantitative easing program intact.

Still, Forex traders will watch out for Andrew Bailey’s statement about negative interest rates. In January, after an MPC member touted negative rates, Bailey lamented about their complexities. He argued that subzero interest rates would hurt the UK banking sector that is a major employer in the country.

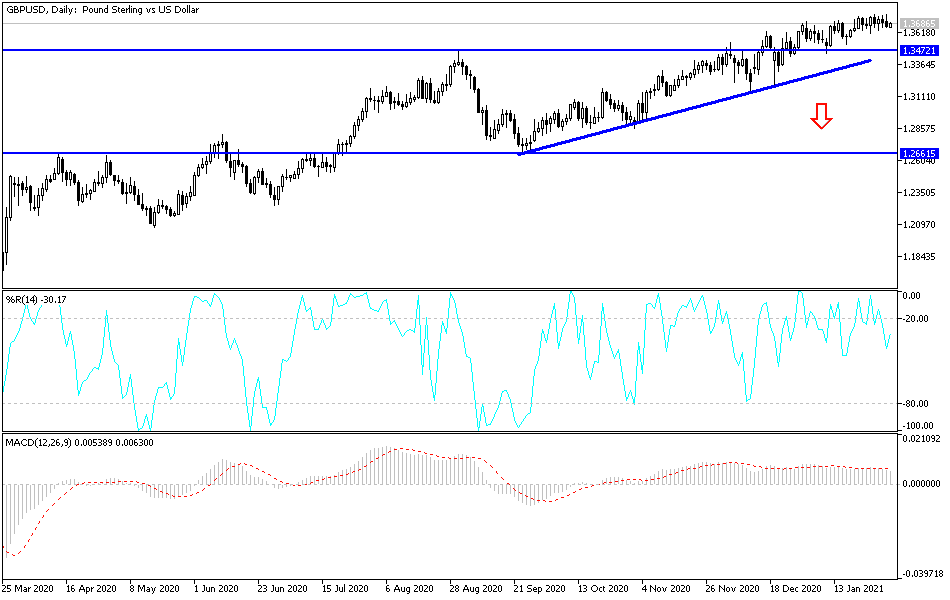

GBP/USD Technical Outlook

The GBP/USD price rose to a high of 1.3753 yesterday and then quickly gave up on those gains and dropped to 1.3653. On the four-hour chart, the price is range-bound, with the resistance being at 1.3753 and the main support being at 1.3627. Oscillators like the MACD and the Relative Strength Index (RSI) are also at their neutral levels.

Therefore, if the pair drops below the support at 1.3653, it will push bears to retest the next level at1.3627. Also, the pair may attempt to retest yesterday’s high again.