Yesterday's trading session was the best daily performance for the GBP/USD pair in nearly a month-and-a-half. The pair had jumped to the 1.4240 resistance level before retreating quickly amid profit-taking. Technical indicators reached strong overbought areas, reaching the 1.4082 support level before settling around 1.4140 at the beginning of trading on Thursday. Sterling is exposed to more gains amid the prominent global progress in British vaccination rates, which contributed to the decision of the British government to announce a roadmap with specific times to end restrictions. The sterling gains against the dollar reached their highest in three years.

Commenting on the distinctive gains of the pound in the Forex market against all other major currencies, Analyst Matthew Wheeler, Head of Market Research at GAIN Capital reveals the single most important factor driving the rally in the GBP/USD above 1.4200 highs. Facing COVID-19, Brexit, political turmoil in the United States, and countless other storylines, there has been one consistent trend in the foreign exchange market over the past six to 12 months: a relentless attempt to buy the GBP/USD pair.

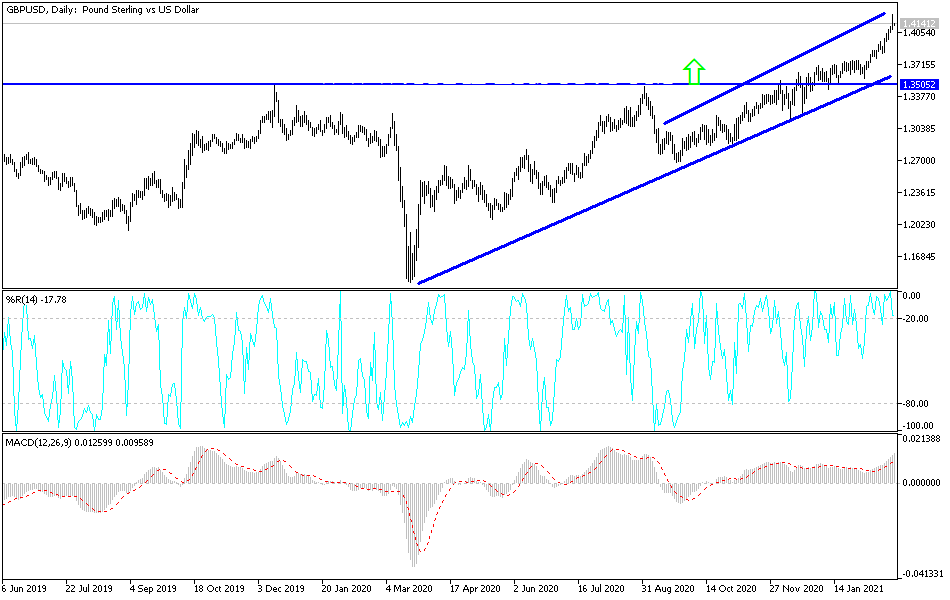

After hitting a low near the 1.1500 support as COVID concerns peaked in March, the world's third most-traded currency pair rose over 2,600 points in the past 11 months to break the 1.4100 high this week.

While there are countless reasons for any movement in the market, the single biggest factor driving the continued rally in the GBP/USD pair is bond yields, or specifically the difference between short-term yields on British bonds and US Treasury bills. Yields on UK 2-year bonds have risen faster than their rivals in the United States, representing a combination of Brexit relief, vaccination distribution, and near-term economic recovery prospects.

Overall, the tightening of the spread between short-term bonds in the UK and the US makes the UK (and thus the British pound) more attractive to global investors.

This week. British Prime Minister Boris Johnson has laid out the government's roadmap to exit from the lockdown which shows that a return to normal life is only likely by June at the earliest, but economists said the cautious approach would still put the economy on track for a strong recovery. Johnson said the reopening of the economy will begin with the return of schools on March 08, with restrictions further eased at the end of March. The program will culminate in the reopening of nightclubs, mass events and the abolition of all restrictions by June 21, provided that they are planned.

At the same time, Johnson said he would "cautiously but irreversibly" open the country.

Technical analysis of the pair:

The general trend of the GBP/USD remains bullish as long as it is stable above the psychological resistance of 1.4000. The recent bullish breakouts were stopped in light of technical indicators reaching strong overbought areas, which normally activates profit-taking, but at the same time does not stop the trend, as every decline will be an opportunity for Forex investors to return to buy the sterling. The closest support levels for the pair are currently 1.4090, 1.4000 and 1.3920.

I would still prefer buying the pair from every downside as long as the British advance in the pace of vaccinations and abandonment of restrictions remain in place.

Today's economic calendar:

There are no significant UK economic releases today. All focus will be on US economic data, the most important of which will be the growth rate of the US economy, durable goods orders, US jobless claims weekly, and pending US home sales.